New Residential Records Set In 2019.

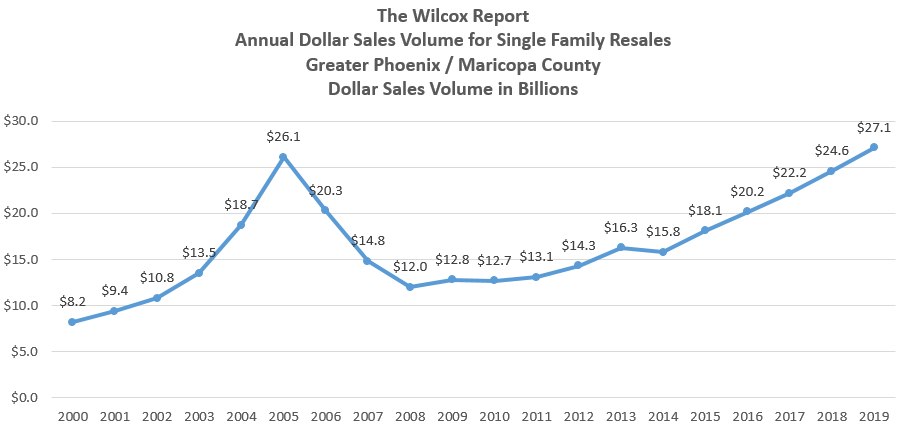

Record Year in 2019 for Dollar Sales Volume.

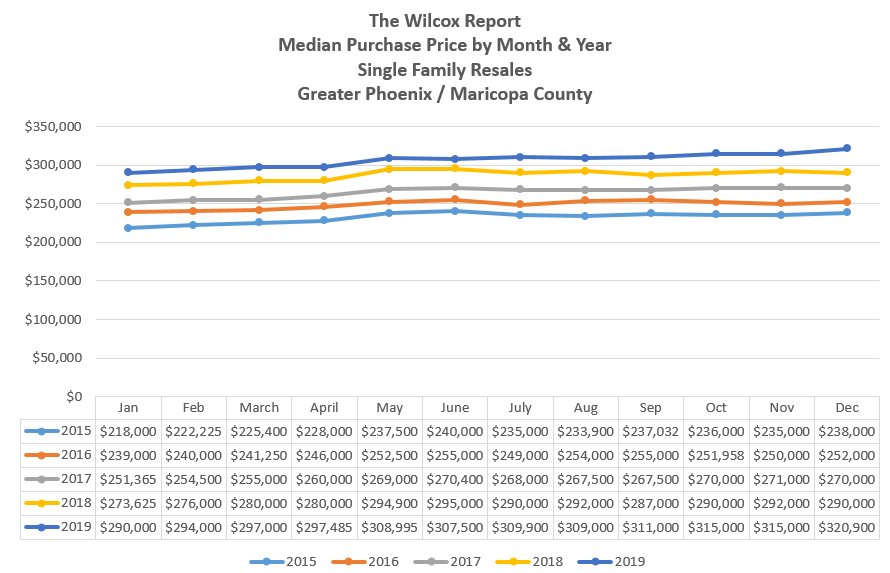

December 2019 Sets New Record for Month with Highest Median Purchase Price.

2020 Predictions.

Dollar sales volume in 2019 for sales of single family resales in Greater Phoenix (Maricopa County) was the highest ever for a single year. Dollar sales volume in 2019 exceeded the previous record year by one billion dollars. Dollar sales volume in 2019 was $27.1 billion in 2019 beating the previous record set fourteen years in 2005 when it was $26.1 billion. See Chart one for dollar sales volume for sales of single family resales from 2000 through 2019.

The median purchase price in 2019 trended differently than the preceding four years. From 2015 through 2018 the median purchase price of a single family resale in Maricopa County peaked in the month of June, then went down in July, and worked its way pack up by December, but never quite as high as the preceding June. See Chart two. In 2019 for the first time in the last five years the median purchase price was higher in July than June. And for the first time in the last five years it was higher in December than June. The December 2019 median purchase price for single family resales in Maricopa County hit an all-time high finishing at $320,990. This is $30,990 or 10.7 percent higher than in December 2018 and January 2019 when it was $290,000 in each of those months.

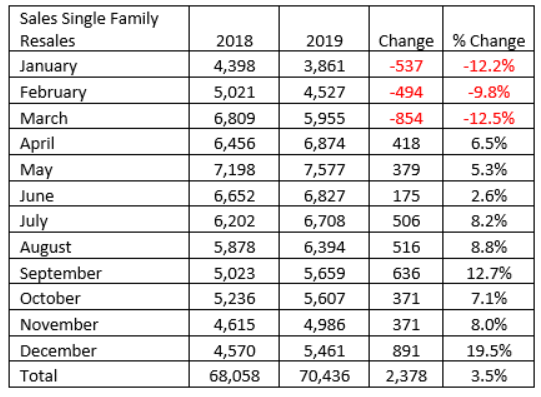

Sales of Single Family Resales

Sales of single family resales in Maricopa County were dismal at the beginning of 2019 compared to 2018. Year-over-year sales in each of the first three months of 2019 were less than they were in 2018. Sales were down twelve percent in the first quarter of 2019 compared to 2018. Then in April 2019 year-over-year sales reversed course. Sales in April 2019 were 6.5% higher than April 2018. From April 2019 through December 2019 sales were higher in each of these months year-over-year. In fact, sales in December 2019, were a whopping 883 or 19.5 percent higher than in December 2018, making December 2019 the best month of 2019 percentage wise for year-over-year sales. Overall there were 2,378 or 3.5 percent more sales in 2019 than 2018. See Table one.

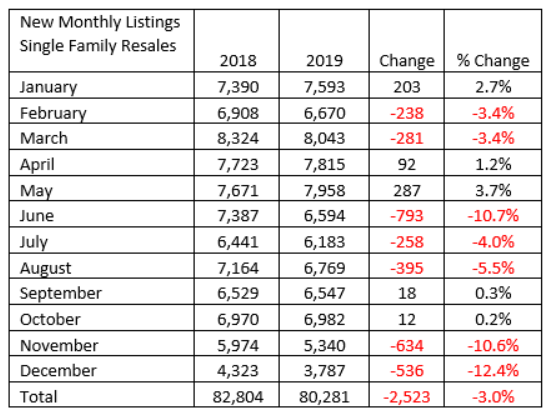

New Monthly Listings of Single Family Resales

Overall new monthly listings of single family resales in 2019 were 2,523 or three percent less than in 2018. Only two months in 2019, January and May, had significant year-over-year new monthly listings than in 2018. See Table two. New monthly listings in December 2019 were under 4,000. This is the lowest number of new monthly listings for a month of December this century.

This report compiled information from the Arizona Regional Multiple Listings Services, Inc (ARMLS). According to ARMLS data there were 86,494 listings in ARMLS that sold in Maricopa County (Greater Phoenix) in 2019. The residential property categories that made up these sales were single family, patio, townhouse, apartment style, gemini twin home, mobile, and modular and loft style. This report focuses on single family sales since 70,436 or 81 percent of the 86,494 sales were in this category.

In 2019 both dollar sales volume and the median purchase price for single family resales reached levels never before seen in Maricopa County. Driving these levels up were a limited supply of available homes with high demand to own. High demand to own was fueled by record population and job growth. The number of people employed in Maricopa County has never been higher. As to population increases, for the last three consecutive years the U.S. Census Bureau published data showing Maricopa County gained more people than any other county in the U.S. Much of our population increase came from net migration. Expect in 2020, when the U.S. Census Bureau releases their new county population increases, that Maricopa County once again, will be the number one county in the U.S. for population increase.

Recent data shows that the number of year-over-year new monthly listings was low. Because of this the median purchase price will likely continue to climb in 2020 in the most popular price ranges. Owners seeing the increases in prices may be encouraged to list their homes. Buyers to be prepared when an opportunity presents itself, should learn all they can about the neighborhoods they are interested in. They can do this by hiring a real estate agent who can show them listing and sales trends in these neighborhoods. Their real estate agent can alert them when a new listing arrives. The other part of the equation for buyer preparedness is for a buyer to get pre-approved for how much home they can afford before looking at homes. They should do this by meeting with their loan officer. Their loan officer can help them address issues that may prevent them from being able to close escrow once under contract.

2020 PREDICTIONS

Inventory to be tight

Interest rates expected to be low

Purchase price will go up in most popular price ranges

Lots of buyers

Should be 110,000 sales in 2020 (this number includes both resale and new home sales for single family homes, condos and townhouses),

Fletcher R. Wilcox is V.P. of Business Development, a Real Estate Analyst at Grand Canyon Title.

Grand Canyon Title is a subsidiary of Fidelity National Financial (FNF). FNF is ranked 302 on the FORTUNE 500® list of America’s largest companies.

Fletcher is the founder of The Wilcox Report. His market analysis on residential real estate in Greater Phoenix has been mentioned in publications such as the Wall Street Journal, MarketWatch, Bloomberg News, HousingWire.com, National Mortgage News, the Arizona Republic and the Phoenix Business Journal. He has been a guest speaker on both local and national TV and radio. He served on one of the three Arizona Association of REALTORS® subcommittees which made recommendations for changes to the 2017 AAR Residential Resale Real Estate Purchase Contract. Fletcher may be reached at mailto:fwilcox@gcta.com and 602.648.1230

Follow Fletcher