THE WILCOX REPORT

By

Fletcher R. Wilcox

V.P. Business Development, Grand Canyon Title Agency

FWILCOX@GCTA.com 602.648.1230

This report was published in the November 2018 edition of the Arizona Journal of Real Estate & Business

Mortgage Rates in Perspective: Do You Remember How High Rates Used to Be?

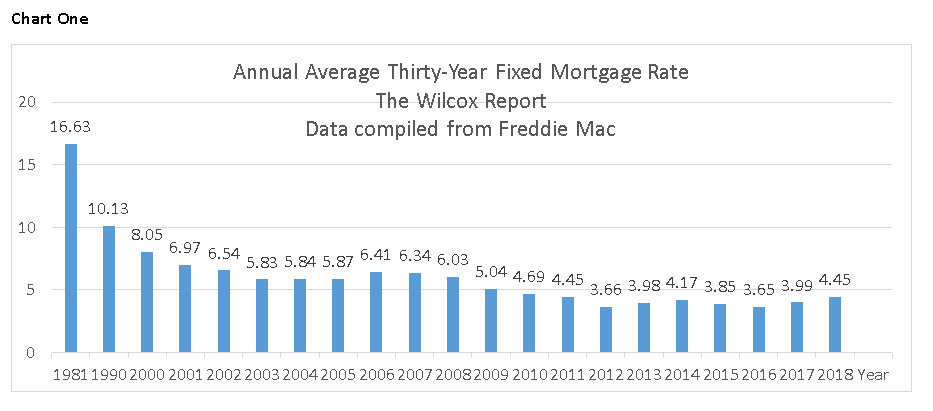

Since 1971 Freddie Mac has tracked the thirty-year fixed mortgage rate. Chart One shows a partial history of their tracking. The year with the highest annual average thirty-year fixed mortgage rate was in 1981 when it was 16.63 percent. In 1990 it was 10.13 percent. At the turn of the century it was 8.05 percent. The annual average thirty-year fixed mortgage rate from 2012 through 2017 was under four percent for five of these six years. The year it was the lowest since 1971 was 2016 when it was 3.65.

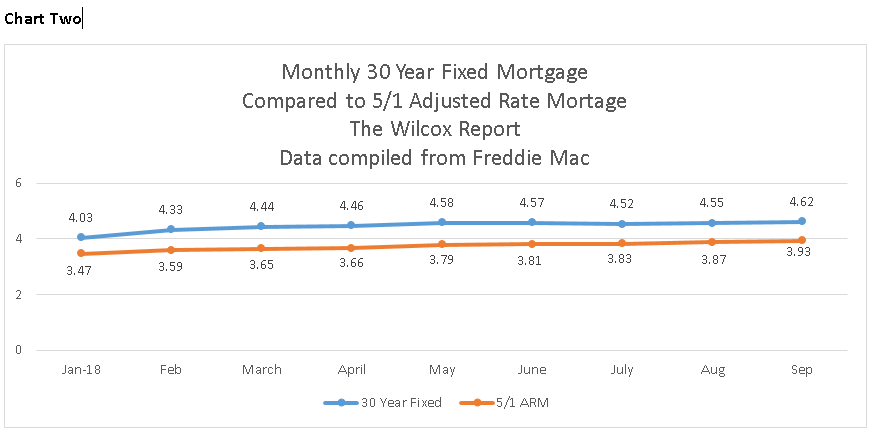

In 2018 the monthly average thirty-year fixed mortgage rate was over four percent every month from January through September. The September 2018 thirty-year fixed mortgage rate of 4.62 percent is the highest rate in seven years. It is expected to continue to increase due to the strong economy, tax cuts and expectations for increases in inflation.

There is an alternative to get a lower mortgage rate than what the thirty-year fixed mortgage rate has to offer. It is the 5/1 adjustable rate mortgage known as the 5/1 ARM. For the first five years this mortgage rate is fixed at a lower rate than the thirty-year fixed rate. Then after five years it adjusts once a year. Eventually the 5/1 ARM could go higher than the thirty-year fixed rate. Chart Two compares the 5/1 ARM to the thirty-year fixed rate for the first nine months of 2018. It shows that in September the 5/1 ARM rate was slightly below four percent at 3.93 percent compared to 4.62 percent for the thirty year fixed mortgage rate.

While increases in mortgage rates equates to consumers paying more in monthly principle and interest some consumers will be able to offset these increases due to a rise in their personal income. Personal income in Arizona was up 3.8 percent in the second quarter of 2018.

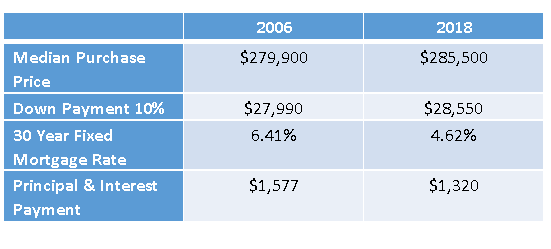

A Mortgage Payment Today is Less Expensive than in Previous Real Estate Boom

In 2018 the median purchase price finally surpassed the all-time high median purchase price record set in 2006. In 2006 the annual median purchase price was $279,900, for a previously owned single family home in Maricopa County, compared to $285,500 thus far in 2018. However, a mortgage payment in 2018 is still cheaper when compared to 2006. The principle and interest payment for a thirty-year fixed mortgage in 2006 for the median purchase price of $279,900 with ten percent down was $1,577 compared to $1,320 in 2018 for a median purchase price of $285,500 with ten percent down. The difference being the thirty-year fixed mortgage rate. In 2006 it was 6.41 percent compared to 4.62 percent in September 2018.

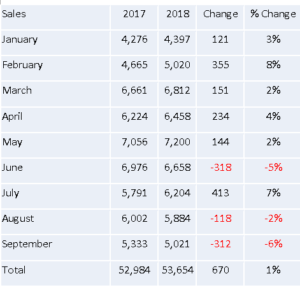

Sales and New Monthly Listings for Previously Owned Single Family Homes in Greater Phoenix

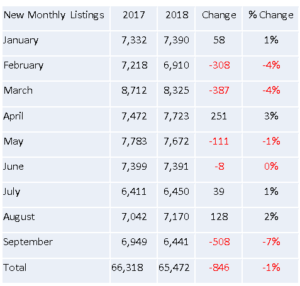

Sales of previously owned single family homes in Greater Phoenix (Maricopa County) were down six percent in September 2018 compared to September 2017, but up were up 1% overall for the first nine months of 2018 compared to 2017. New monthly listings of previously owned single family homes were down seven percent in September 2018 compared to September 2017 and were down one percent overall for the first nine months of 2018 compared to the same time period last year.

Conclusion

Sales of previously owned single family homes in Greater Phoenix are down for the last three out of four months compared to the same time period last year. It is my opinion that this is due primarily to lack of inventory and not as much the increase in mortgage rates. However, mortgage rates most likely will continue to rise because of the strong economy. It would not be a surprise over the next few months for the thirty-year fixed rate to hit five percent and the 5/1 ARM to hit four percent.

Fletcher R. Wilcox

V.P. Business Development, Real Estate Analyst & Author of www.TheWilcoxReport.com

A report on real estate, lending and job growth trends in Greater Phoenix.

Grand Canyon Title Agency

602.648.1230

Follow Fletcher