MARKET UPDATE by The Wilcox Report ™

BY

FLETCHER R. WILCOX

mailto:fwilcox@gcta.com 602.648.1230

Grand Canyon Title Agency

This article was first published in the Arizona Journal of Real Estate & Business

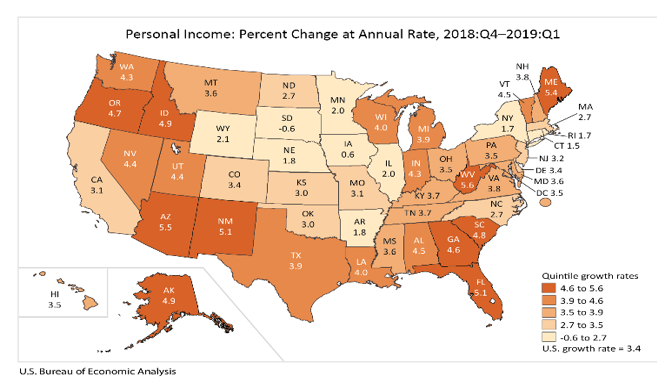

First Quarter Personal Income Starts out with a Boom for Arizona

According to a report from the U.S. Bureau of Economic Analysis the national average for first quarter state personal income increased 3.4 percent over the fourth quarter of 2018. Not so for Arizona. Arizona’s personal income was over two percent higher than the national average. It was 5.5 percent making it the second-fastest of all 50 states. Only West Virginia beat Arizona finishing at 5.6 percent. The report identified healthcare and social assistance as the leading contributors to Arizona’s personal income increase.

What does this increase mean for the citizens of Arizona? Larger paychecks.

Chart one

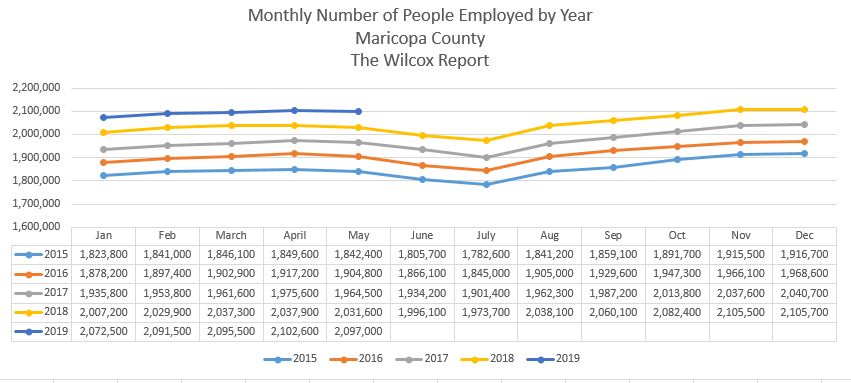

Job Trends for Maricopa County (Greater Phoenix)

The number of people with a job in Maricopa County continues to grow. In May 2019, in Maricopa County there was a quarter million or 254,600 more people with a job than in May 2015. In May 2019 there was 2,097,000 people employed compared to 1,842,400 in May 2015.

Chart two shows the monthly number of people employed from January 2015 through May 2019. While year-over-year employment has increased the number of people employed during a year fluctuates. We see the following seasonal job pattern for the last five years in Maricopa County. Chart two shows that starting in January the number of people employed grows every month through April. Then from April through July the number of people employed each month decreases. July is the month of the year with the least number of people employed. The average decrease in the number of people employed in July compared April is 3.6 percent or 69,400 less jobs. Then from July through December the number of people employed increases each month.

Chart two

Source: Arizona Office of Economic Opportunity

By December the average number of people employed compared to July is 7.1 percent or 132,250 higher. So for every job loss from April through July, there was almost a two-to-one gain of jobs from July through December.

Where are Some Jobs Coming From?

The Arizona Governor’s office sent out the press release California Companies Flocking to Arizona. They showed the following:

- Since 2015, a total of 49 companies have chosen to set up shop in Arizona.

- The exodus of California businesses has brought Arizona more than 18,000 jobs and over $9 billion in capital.

- California companies choosing to conduct business in Arizona come from a range of industries, including banking and finance, information technology, and bioscience and biotechnology.

- California companies such as ZipRecruiter, Stitch Fix, Apple and Google are among those that have chosen to discover Arizona.

or a short presentation as to reasons why Scottsdale is a destination for some Californians watch Why People are Moving to Scottsdale from California

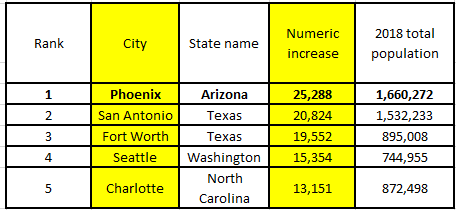

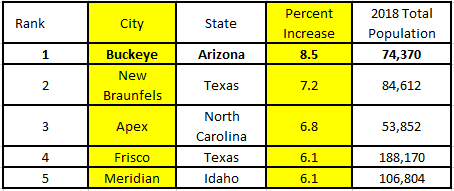

Two Arizona Cities Number One on U.S. Census Bureau’s Population Lists

The first list is the top five cities with the largest numeric population increase between July 1, 2017 and July 1, 2018, that had populations of 50,000 or more on July 1, 2017. The City of Phoenix topped the list with an increase of 25,288 people.

The second list with the same aforementioned parameters was the five fastest growing cities by percentage increase. The City of Buckeye topped the list with an increase of 8.5 percent.

Both Phoenix and Buckeye are located in Maricopa County. In the June edition of this publication it was reported that Maricopa County topped all counties in the U.S. in numeric population increase.

Table one

Table two

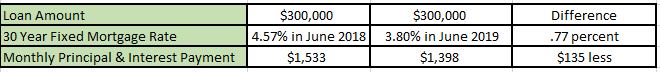

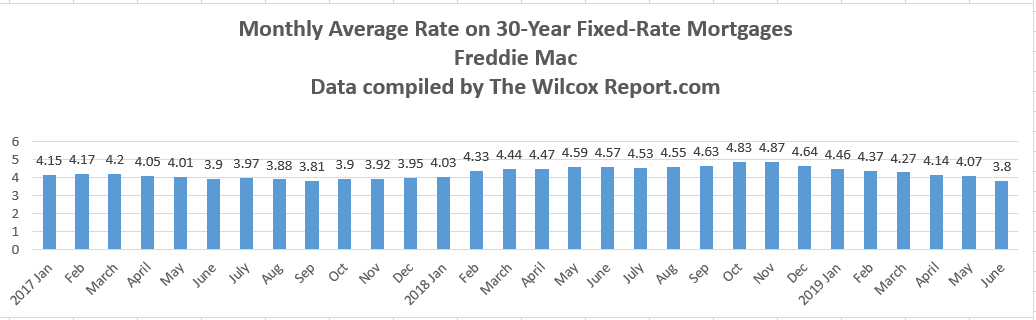

Thirty-Year Fixed Mortgage Rate Goes Down to Under Four Percent

Chart three shows the monthly average thirty-year fixed mortgage rate from January 2017 through June 2019. The average thirty-year fixed mortgage rate in June was 3.8 percent. This was the first time since December 2017 that it finished under four percent for a month. A lower mortgage rate increases buyer affordability, but it may also encourage more competition amongst buyers for limited inventory since more buyers may jump into the purchase market.

A lower mortgage rate increases affordability by lowering the monthly principle and interest a borrower has to pay. According to data compiled from Freddie Mac, the June 2019 monthly average thirty-year fixed mortgage rate was 3.8 percent or .77 percent lower than June 2018 when it was 4.57 percent. Let’s compare what a principle and interest payment would be for residential loan of $300,000 loan in June 2018 to June 2019 when the mortgage rate was .77 percent lower. If a borrower obtained a $300,000 loan in June 2018 they would pay $135 more in principal and interest per month or $1,620 more per year than if they obtained a loan of $300,000 in June 2019. See Table three for the comparison.

Table three

Chart three

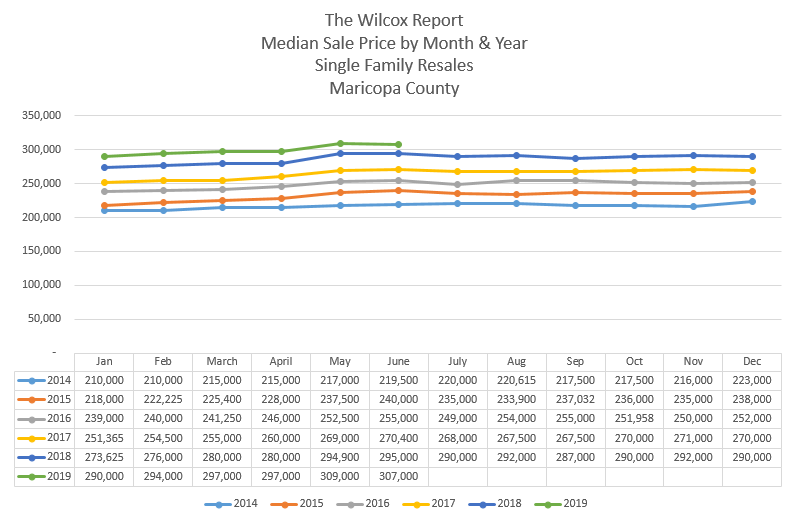

June Single Family Resale Results

There were more sales of single family resales in Maricopa County this June than last June. Sales in June 2019 were 2.5 percent or 164 more than June 2018. The median sale price for a single family resale finished at $307,000 in June. This is only the second consecutive month it has been over $300,000. June’s median sale price of $307,000 was one thousand dollars lower than May 2019, but twelve thousand higher than June 2018. New monthly single family resale inventory in June 2019 was down by 844 listings or 11.4 percent compared to June 2018.

Chart four

Conclusion

Increases in population, jobs and personal income along with lower mortgage rates continues to fuel the momentum to own a home. Most buyers from California find our home prices very reasonable compared to California’s home prices, thus adding to the demand to own. This demand to own, with limited inventory, has increased the median sale price from $295,000 in June 2018 to $307,000 in June 2019.©

If you are a real estate agent and want some fresh ideas, contact me to find out when I am teaching Influencer Marketing: How to Use Market Information to Influence Sellers & Buyers.

Fletcher R. Wilcox is V.P. of Business Development and a Real Estate Analyst at Grand Canyon Title.

Grand Canyon Title is a subsidiary of Fidelity National Financial (FNF). FNF is ranked 302 on the FORTUNE 500® list of America’s largest companies.

Fletcher is the founder of The Wilcox Report. His market analysis on residential real estate in Greater Phoenix has been mentioned in publications such as the Wall Street Journal, MarketWatch, Bloomberg News, HousingWire.com, National Mortgage News, the Arizona Republic and the Phoenix Business Journal. He has been a guest speaker on both local and national TV and radio. He served on one of the three Arizona Association of REALTORS® subcommittees which made recommendations for changes to the 2017 AAR Residential Resale Real Estate Purchase Contract. Fletcher may be reached at mailto:fwilcox@gcta.com and 602.648.1230

Follow Fletcher