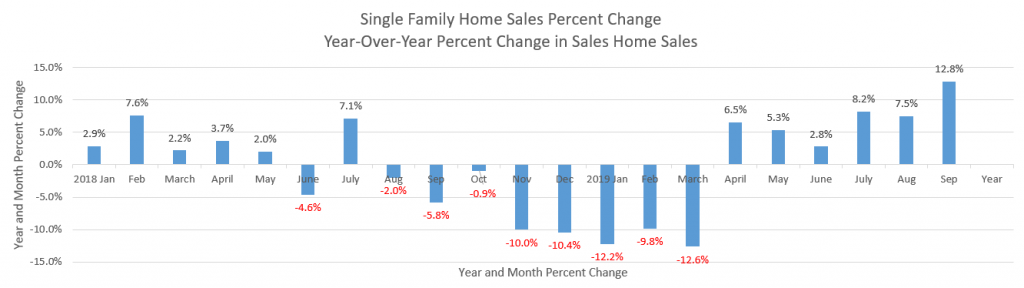

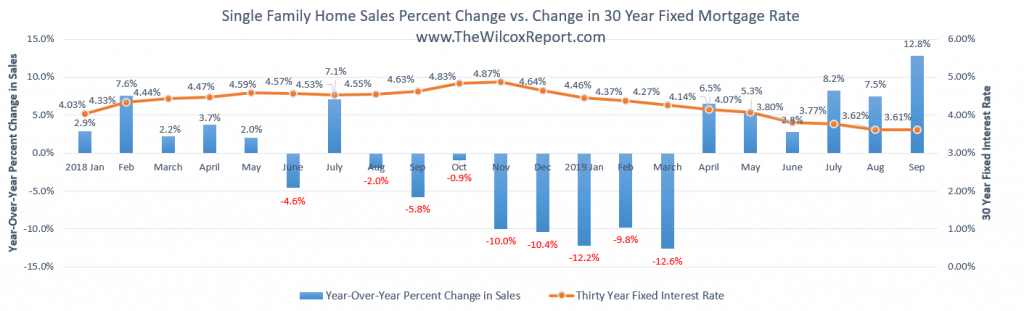

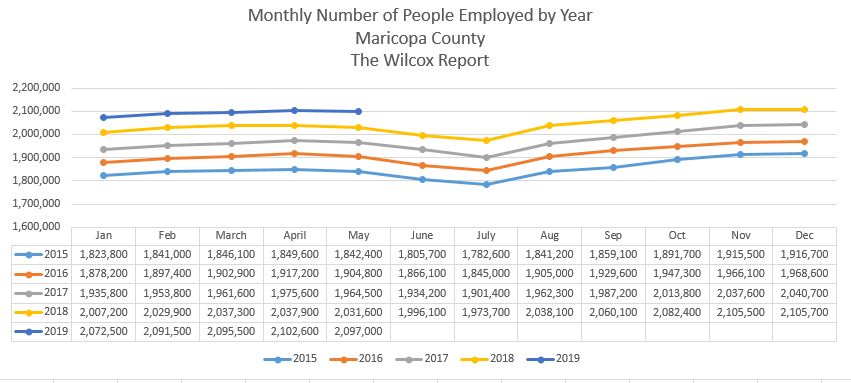

Which is the best month of the year to close on a home?

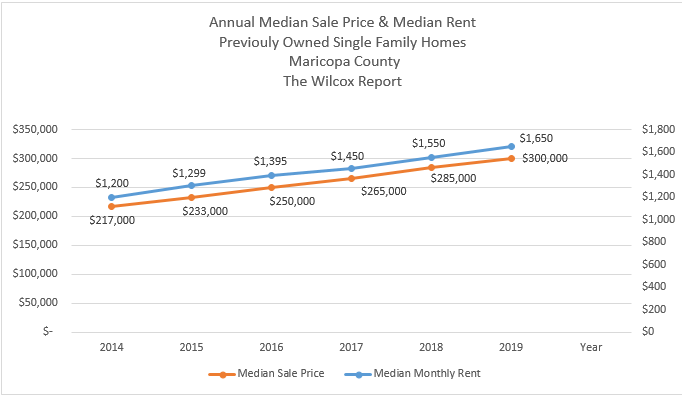

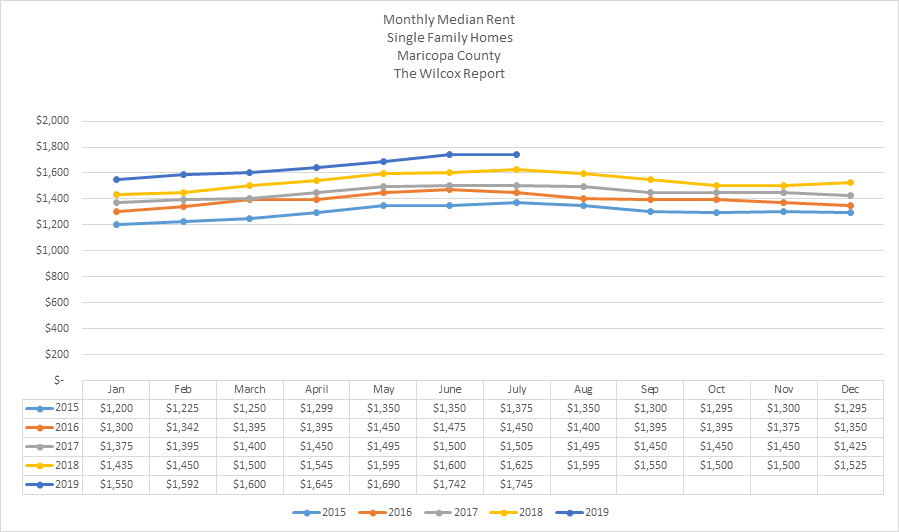

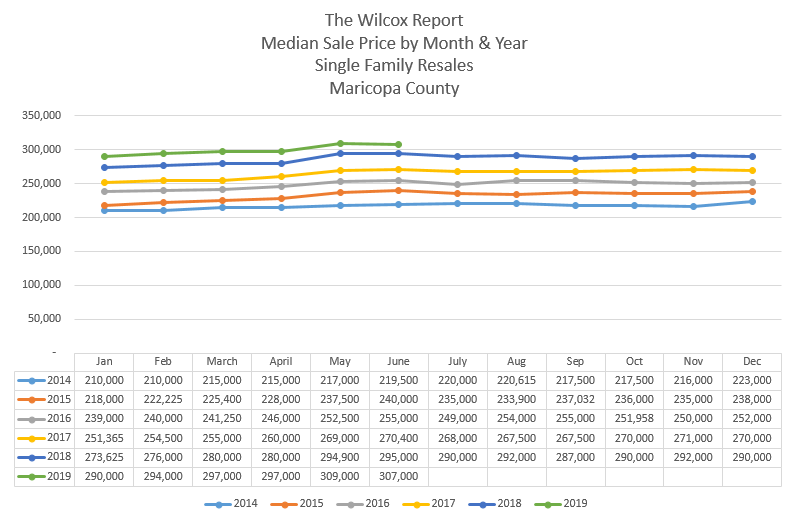

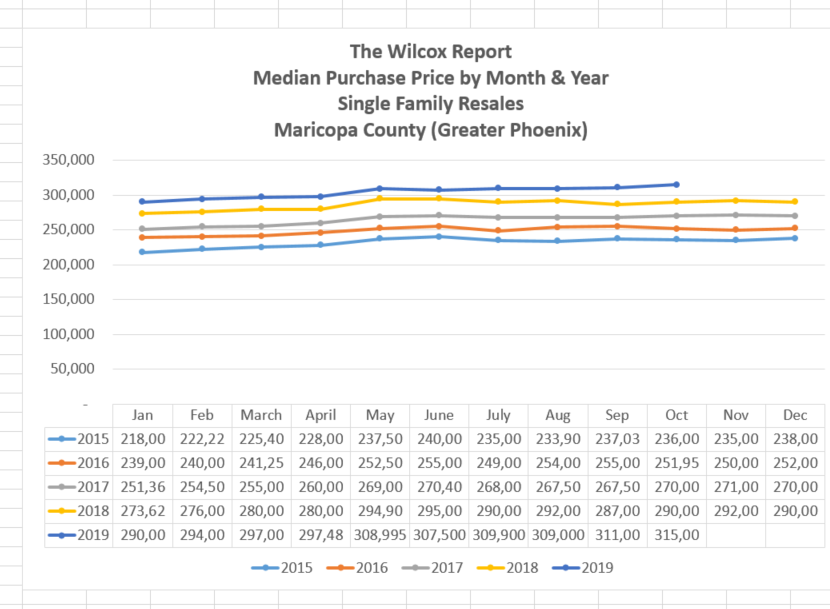

It all depends on a home buyer’s situation. If however, the primary concern is paying the lowest purchase price, than right now may be the best time of the year to kick-in a home buyer campaign. For each of the years shown in Chart one, 2015 through 2018, the month with the lowest median purchase price is January. For each of these years, the median purchase was between five to nine percent higher the following December. By the end of 2019 we will see a repeat of this pattern.

So, if the goal is paying the lowest purchase price, then starting today, may be the best time of the year for a buyer to start looking for a property to get under contract with the goal to close escrow in January 2020 or as close to January 2020 as possible.

The information in Chart one is for the median purchase price of a single family resale in Maricopa County (Greater Phoenix). Any particular zip code or subdivision in Maricopa County may differ from Chart one due to seasonal, inventory or price range differences. The information for Chart one was compiled from the Arizona Regional Multiple Listing Area, Inc., known as ARMLS.

Fletcher R. Wilcox is V.P. of Business Development, a Real Estate Analyst and Teacher of Influencer Marketing at Grand Canyon Title.

Grand Canyon Title is a subsidiary of Fidelity National Financial (FNF). FNF is ranked 302 on the FORTUNE 500® list of America’s largest companies.

Fletcher is the founder of The Wilcox Report. His market analysis on residential real estate in Greater Phoenix has been mentioned in publications such as the Wall Street Journal, MarketWatch, Bloomberg News, HousingWire.com, National Mortgage News, the Arizona Republic and the Phoenix Business Journal. He has been a guest speaker on both local and national TV and radio. He served on one of the three Arizona Association of REALTORS® subcommittees which made recommendations for changes to the 2017 AAR Residential Resale Real Estate Purchase Contract. Fletcher may be reached at mailto:fwilcox@gcta.com and 602.648.1230