2018 Results — 2019 Predictions

The Residential Real Estate Market in Greater Phoenix (Maricopa County)

By

Fletcher R. Wilcox

V.P. Business Development & Real Estate Analyst

Grand Canyon Title

FWilcox@gcta.com 602.648.1230

This article was published January 29, 2019 in the Arizona Journal of Real Estate & Business

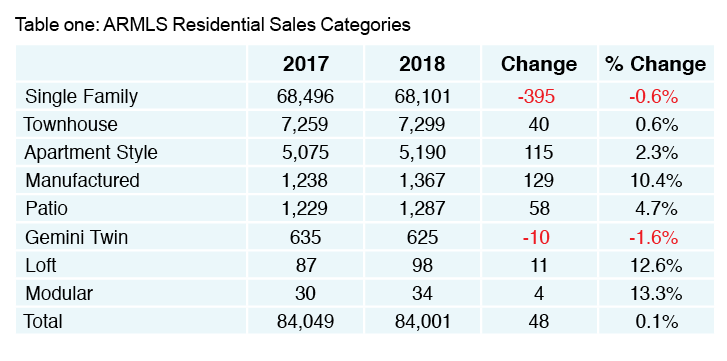

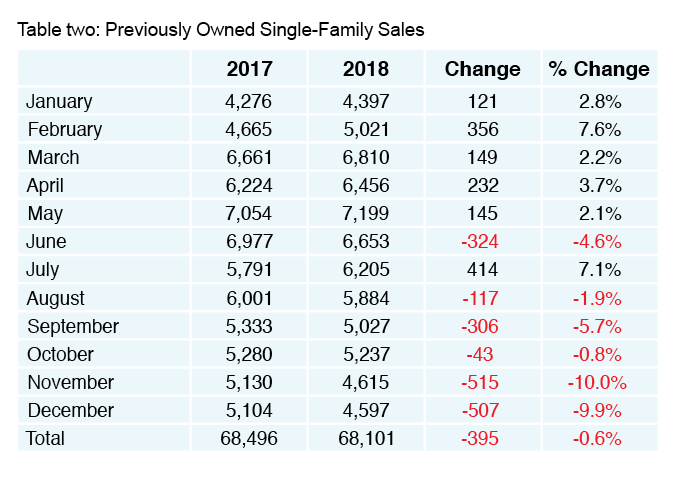

The total number of residential sales in 2018 was equal to the number of sales in 2017. According to data from The Arizona Regional Multiple Listing Services, Inc. known as ARMLS, sales in Maricopa County (Greater Phoenix) in 2018 were 84,001 compared to 84,049 in 2017. When the number of sales are broken down by the eight ARMLS residential categories there were some small year-over-year differences. The only two categories in 2018 that were down year-over-year were single family and gemini twin sales. Single family sales were down 395 or less than one percent and gemini twin sales were down 10 sales or 1.6 percent. The other six categories accounted for 357 more sales in 2018 over 2017. See Table One.

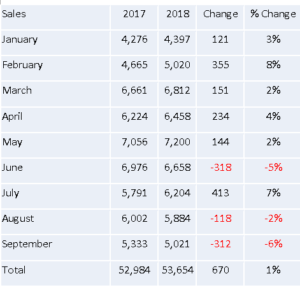

Single Family Sales

Let’s review the residential category that by far had the most sales. Previously owned single family home sales in both 2017 and 2018 were over seventy-five percent of all ARMLS residential sales. When comparing previously owned single family sales year-over-year by month there was a difference the first part of 2018 compared to the last part of the year. From January through June there were 679 more sales compared to the same time last year. Then from July through December there were 1,071 less sales compared to 2017. See Table two.

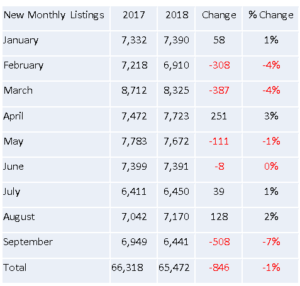

New Listings

Previously Owned Single Family Homes Overall new listings were slightly down in 2018 compared to 2017. There were 82,682 new listings in 2018 compared to 83,616 for a decrease of one percent or 934 new listings. For the number of sales to increase in 2019 there will have to be an increase in new listing inventory in the most desired price ranges. Expect fierce competition amongst real estate agents for listings in the most popular price ranges.

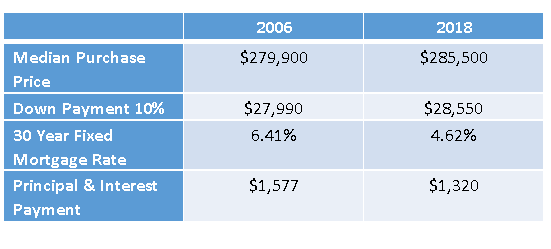

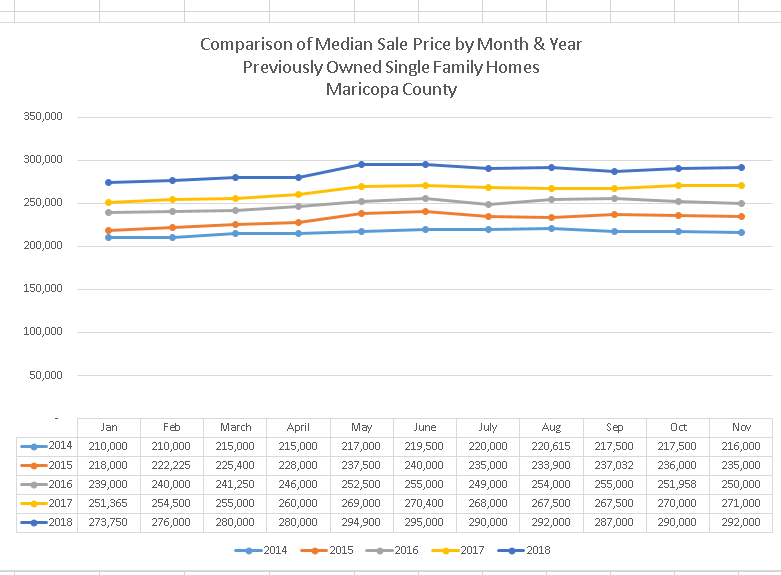

Median Purchase Price

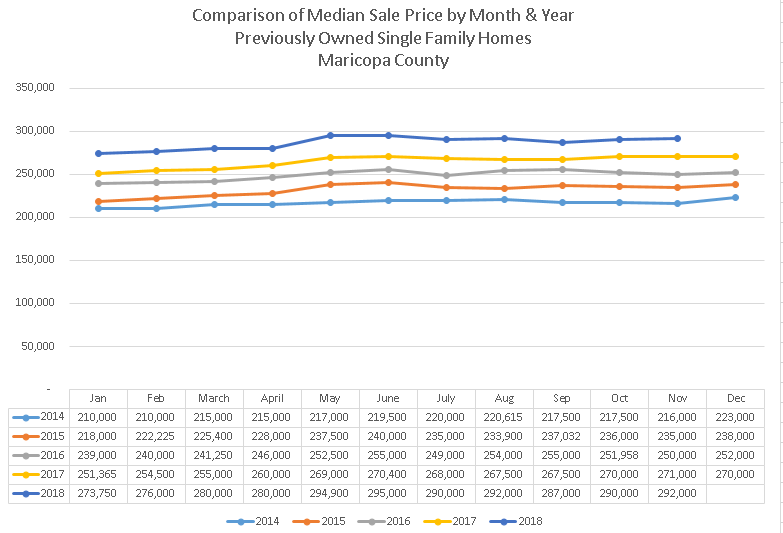

Previously Owned Single Family Homes In 2018 the median purchase price for a previously owned single family home in Maricopa County reached an all-time high. Last May it reached $294,900 surpassing the pre-real estate recession high of $287,500 in June 2006. Sometime in the second quarter of 2019 it most likely will be over $300,000. Chart one shows the median purchase price for a previously owned single family home month by month for the last five years. As seen in the chart, the median purchase is always higher for the same month in the following year. In 2019 this trend should continue. The continual rise in the median purchase price means that there are very few homes still underwater in 2018. There were approximately 350 short sales in 2018, according to ARMLS data. There should be even less in 2019. Of course while rising home prices increase household wealth they decrease affordability, making it more difficult for potential first time homebuyers to purchase. Chart one

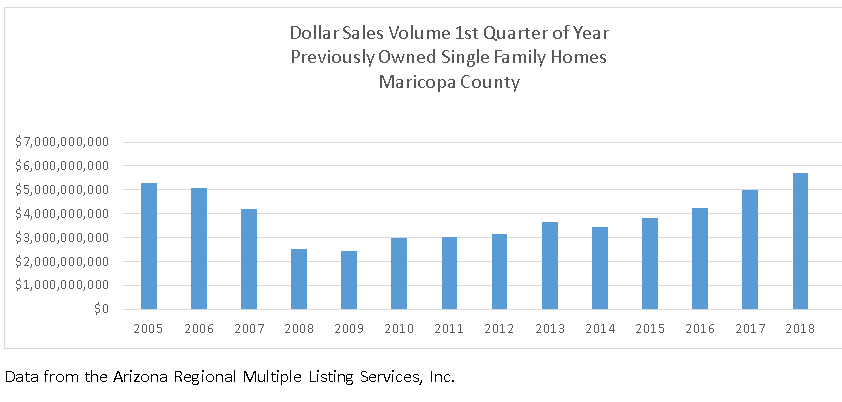

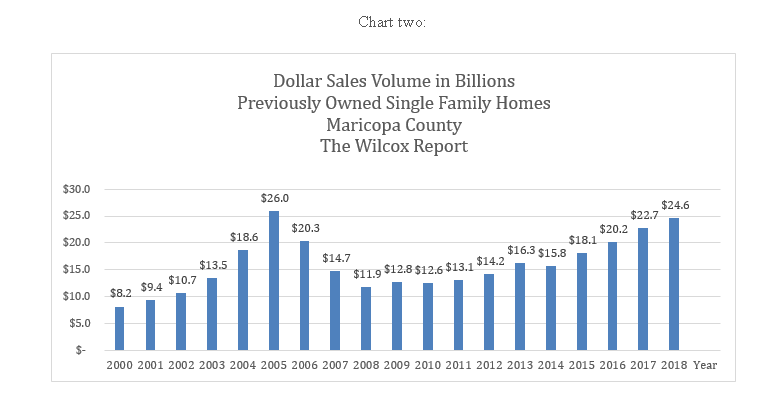

Dollar Sales Volume Dollar sales volume for previously owned single family homes in Maricopa County is the highlight of 2018! According to ARMLS data the 2018 dollar sales volume of $24.6 billion represents the total purchase prices of the 68,101 sales in 2018. See Chart two. Only one previous year has finished with a higher dollar sales volume. That was in 2005 when it was $26 billion represented by 78,419 sales. High dollar sales volume and the number of residential sales in Maricopa County are probably the main reasons new real estate companies, some with disruptive business models, have opened offices in Maricopa County. Because of the many different real estate companies and thousands of real estate agents in Maricopa County expect there to be fierce competition amongst them in 2019 for sellers and buyers.

Competition in 2019

The competition in 2019 amongst real estate companies for sellers and buyers will not be the only battleground. Loan officers will be in competition for qualified buyers. Qualified buyers will in competition for priced right listings.

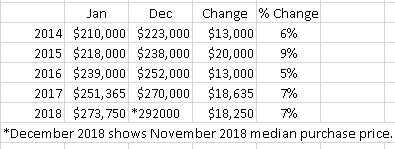

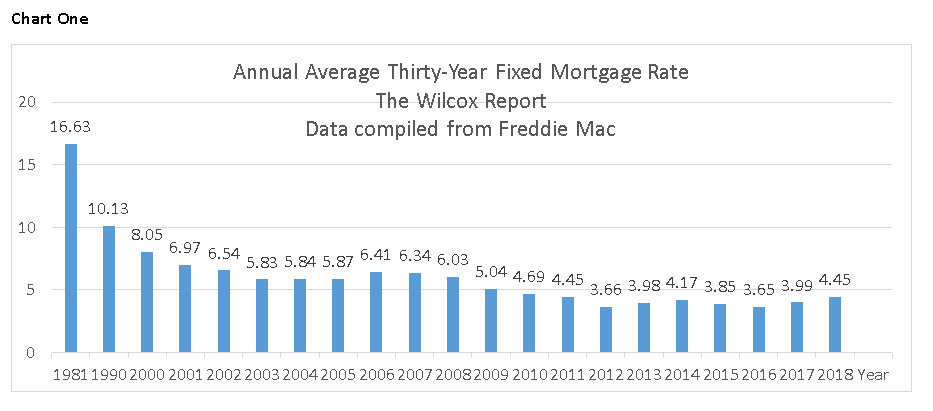

Competition amongst loan officers for purchase business will increase in 2019 because of higher mortgage rates. For the last few years low interest rates have boomed the number of people refinancing into a lower mortgage rate. Refinances provided considerable business for loan officers. Because of the low number of households now refinancing a great portion of loan officer business is wiped out. Because of this, more loan officers will be going after the same purchase business.

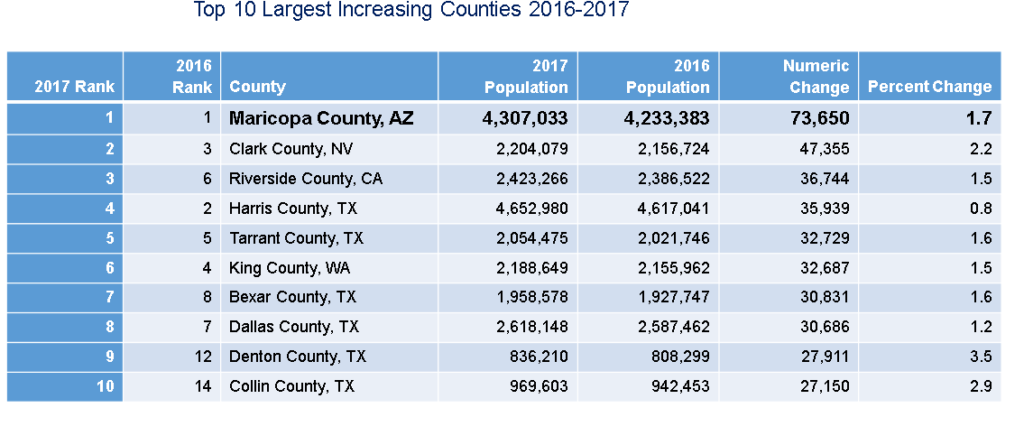

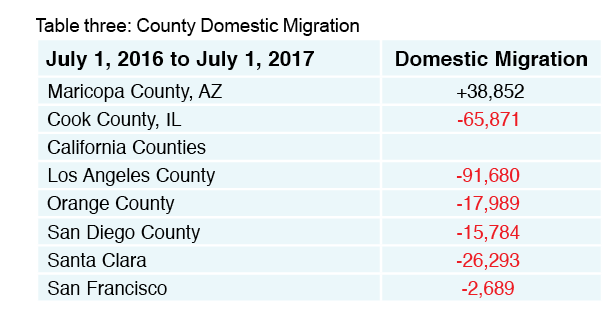

Competition amongst buyers will increase in 2019 because the number of buyers is increasing. Why? More people moving to Maricopa County. According to the U.S. Census Bureau Maricopa County for the last two years gained more people than any other county in the United States. The population of Maricopa County has increased by 155,000 the last two years. Prediction: when U.S. Census data comes out in 2019 Maricopa County for the third year in a row will be the number one county for increase in population.

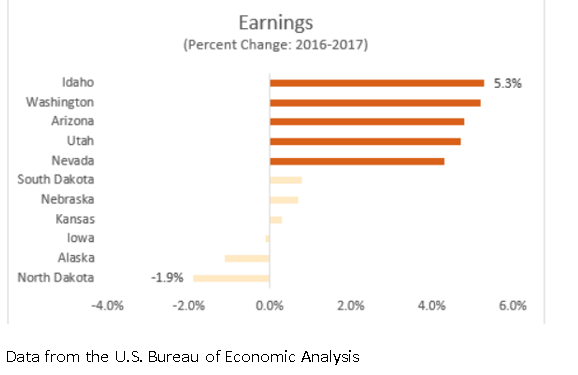

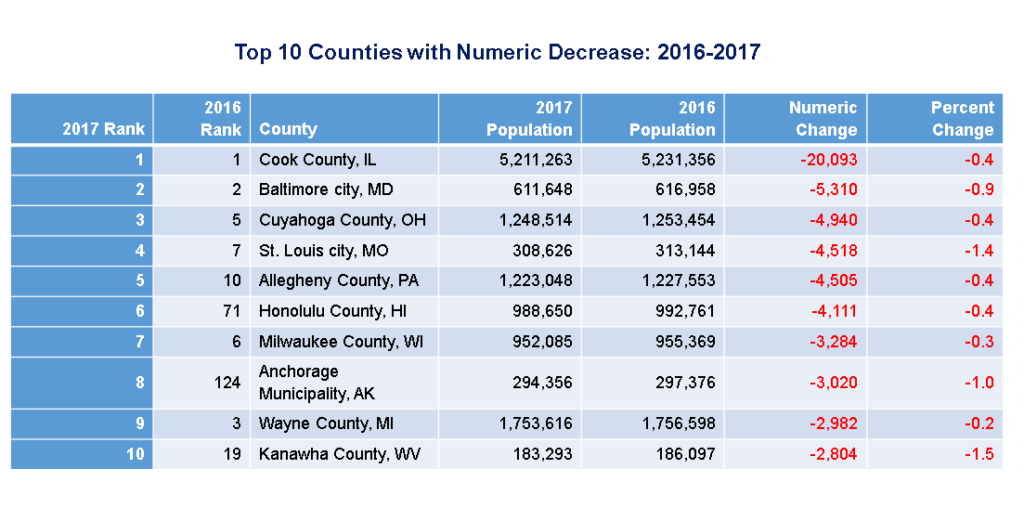

A major reason why Maricopa County’s population will continue to grow is the exodus of people and companies from states that have high taxes and difficult business regulations, and/or have very cold weather, and/or have a political environment that people feel is no longer friendly. Below in Table three is the most recent domestic migration data from the U.S. Census Bureau. Maricopa County’s domestic migration was a net 38,852. Cook County, where Chicago is located, domestic migration was a negative 65,871 people. Los Angeles County lost 91,680 to domestic migration. A popular destination for people leaving Los Angeles County is Maricopa County. When the U.S. Census Bureau releases its 2019 migration data, we should see similar patterns as shown in Table three.

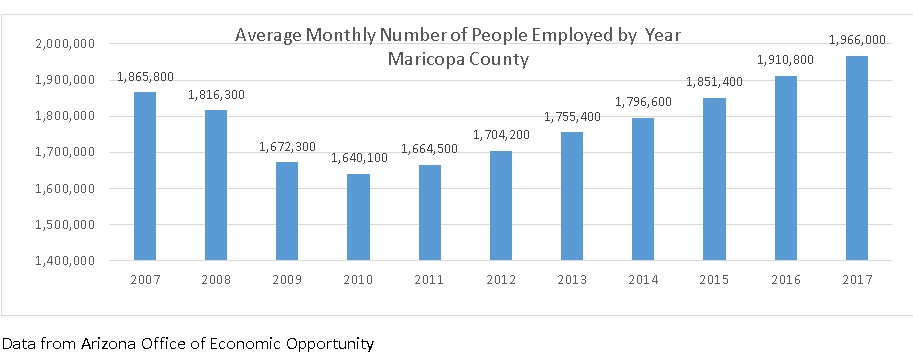

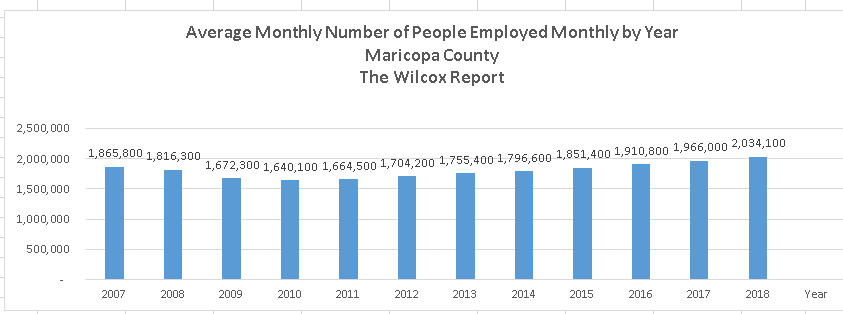

Along with the increase in population has been an increase in jobs. The number of people employed in Maricopa County has gone up substantially the last five years. In 2018 there were 272,600 more people employed than in 2013. By the end of 2019 there should be an additional 65,000 to 70,000 more people employed which will add to the number of people whom will either rent or own.

With a growing number of people employed and with a limited number of priced right listings, the presentation of a buyer’s offer must stand out to be successful.

So Want Does a Real Estate Agent Need to do to be Competitive in 2019?

In 2019 real estate companies with large advertising budgets will be advertising reasons why potential sellers and buyers should work with them. Some will sell technology, some will sell convenience, and others will sell discounts. So as a real estate agent you need to make as many contacts with potential sellers and buyers as you can. Be prepared to give them compelling reasons why they should use you as their agent! If today someone asked you why should I use you as my agent what would be your response? Have a system in place to keep in touch with future clients and past clients. Increase the probability of sellers and buyers picking you as their agent by applying the social psychology principles of persuasion to both your social media and one on one meetings. These principles are Authority, Social Proof and Liking.

Sellers and buyers want relevant real estate information. People defer to those whom have knowledge on real estate trends and are able to communicate trends effectively. This creates authority. People tend to do things they see other people doing. This is social proof. Make it known when you get a listing or close a home with a buyer. Spread the word of your successes with client testimonials. Liking is when someone likes you, they sense you like them and you have things in common. When someone likes you, you have a greater chance of them saying yes to your requests.

All in all, because of population and job growth in Maricopa County, 2019 should be a great year, but competitive year, to be a real estate agent!

Fletcher Wilcox is V.P. of Business Development and a Real Estate Analyst at Grand Canyon Title Agency. Grand Canyon Title Agency is a member of the Fidelity National Financial (FNF) family of companies. They are the nation’s largest group of title companies and title insurance underwriters. FNF is ranked 293 on the FORTUNE 500® list of America’s largest companies. He may be reached at FWilcox@gcta.com 602.648.1230

Fletcher is the founder of The Wilcox Report. His market analysis on residential real estate in Greater Phoenix has been mentioned in publications such as the Wall Street Journal, MarketWatch, Bloomberg News, HousingWire.com, National Mortgage News, the Arizona Republic and the Phoenix Business Journal. He has been a guest speaker on both local and national TV and radio.

He served on one of the three Arizona Association of REALTORS® subcommittees which made recommendations for changes to the 2017 AAR Residential Resale Real Estate Purchase Contract. For more than fifteen years he has taught classes at the Arizona School of Real Estate & Business. He teaches renewal hours in contract law and legal issues. He is a member of the Arizona State Escrow Association, the Arizona Association of REALTORS, the Scottsdale Area Association of REALTORS and is a board member and V.P. of Networking for the Arizona Mortgage Lenders Association. He often speaks at the Heart of Scottsdale REALTOR Marketing Session.

For eleven years he served as a citizen board member on the Phoenix Police Department’s Disciplinary Review & Use of Force Boards. He is a past board member of Alice Cooper’s Solid Rock Teen Center. Fletcher started snowboarding in 2006 and is not very good.