If choice is important to a buyer and a monthly mortgage payment is important to a buyer now may be a good time for a buyer. The information in this article was compiled from the Arizona Regional Multiple Listing Services, Inc. for previously owned single family homes in Maricopa County (Greater Phoenix).

More Inventory More Choices

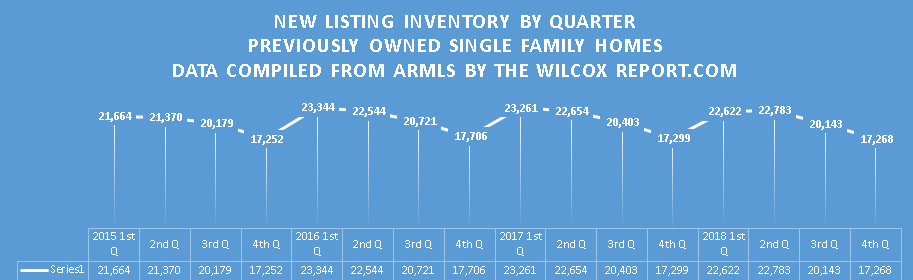

The fourth quarter of the year is the quarter when the least number of sellers put their homes on the market. Then the first quarter of the year kicks off the seller listing season. The first and second quarters of the year is when the highest number of sellers list their homes. Thus, this is the time when a buyer has the most choices of homes to choose from. The chart below shows the number of sellers listings their homes by quarter from 2015 through 2018. For the last three years, the number of new listings in the fourth quarter is down about twenty-five percent or 5,500 less homes hitting the market than the first quarter.

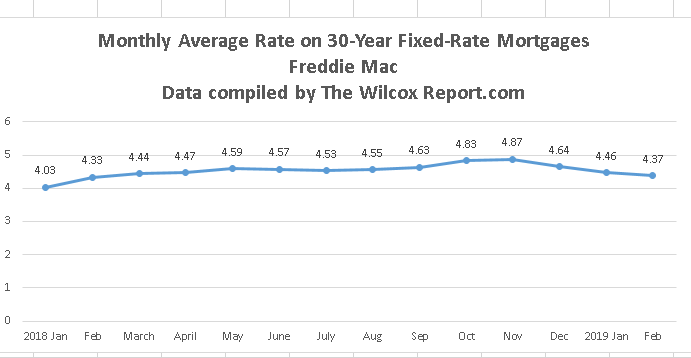

February 2019 Thirty-Year Fixed Mortgage Rate Lowest In A Year

If the monthly amount a homeowner has to pay is important to them the monthly average rate of a thirty-year fixed mortgage in February 2019 was the lowest since February 2018 according to Freddie Mac data. It was 4.37 percent this February compared to 4.33 percent in February 2018. But more significant is that last November the thirty-year fixed mortgage rate was 4.87 percent or 1/2 a percent higher than February 2019. See the chart below. How does this translate into real dollars? If a homebuyer paid $300,000 for a home with ten percent down, the monthly principle and interest with a thirty-year fixed mortgage rate at 4.87 percent is $1,428.04. But if a homebuyer’s thirty-year fixed mortgage rate was 4.37 percent their monthly principle and interest is $1,347.27 or $80.77 less per month. For the year they would pay $969.24 less.

On March 14, Freddie Mac reported that for the week the thirty-year fixed mortgage rate was 4.31 percent.

There May Be One More Reason to Consider Buying

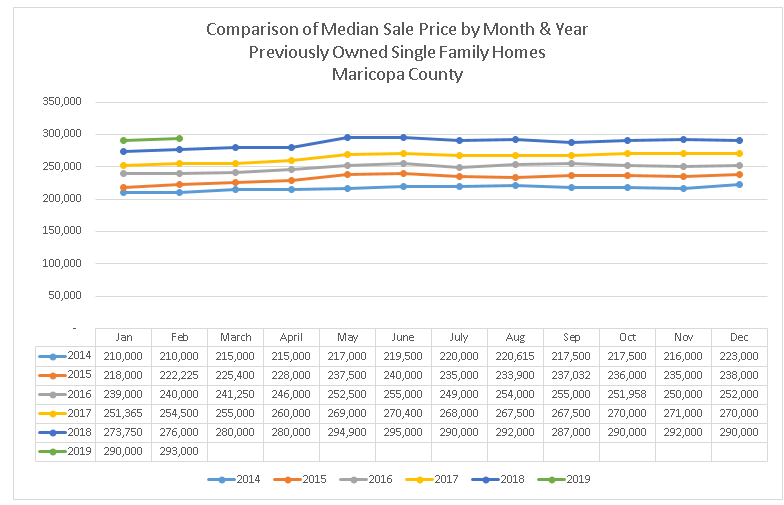

Another reason to consider buying now is rising home prices. The median home sale price continues to go up. In January 2019 it was $290,000. In February 2019 it was $293,000. March 2019 will likely end up somewhere around $295,000 to $297,000 and by June $300,000 to $303,000 (these are just my predictions).

As of today we are almost half way through the peak seller listing season. The thirty-year fixed rate is at its lowest point in a year and sales prices continue to increase. With all this said, there are other factors each and every potential buyer must consider to determine if now is a good time for them to buy.

Fletcher R. Wilcox is V.P. of Business Development and a Real Estate Analyst at Grand Canyon Title. Grand Canyon Title is a subsidairy of Fidelity National Financial (FNF). FNF is ranked 293 on the FORTUNE 500® list of America’s largest companies. Fletcher speaks through out Greater Phoenix and teaches Influencer Marketing. His next public event is March 25 at the Scottsdale Area Association of REALTORS.

Fletcher is the founder of The Wilcox Report. His market analysis on residential real estate in Greater Phoenix has been mentioned in publications such as the Wall Street Journal, MarketWatch, Bloomberg News, HousingWire.com, National Mortgage News, the Arizona Republic and the Phoenix Business Journal. He has been a guest speaker on both local and national TV and radio. He served on one of the three Arizona Association of REALTORS® subcommittees which made recommendations for changes to the 2017 AAR Residential Resale Real Estate Purchase Contract.

Fletcher may be reached at fwilcox@gcta.com and 602.648.1230

Follow Fletcher