Which buyer costs can a seller concession now pay?

Sixty Days Later: The New AAR Purchase Contract

Published May 2, 2017 in the Arizona Journal of Real Estate & Business

http://www.asreb.com/2017/05/sixty-days-later-the-new-aar-purchase-contract/

By

Fletcher R. Wilcox

The Wilcox Report

Grand Canyon Title Agency

As I write this article, it is sixty days since the introduction of the new AAR Residential Resale Real Estate Purchase Contract on February 1, 2017. I will review the change in seller concessions, which is a hot topic, and touch on something that recently happened when a seller agreed to pay the initial appraisal fee — and it was to be included in the seller concessions.

The Seller Concessions clause in the new AAR Contract reads:

2J. Seller Concessions (if any): In addition to the other costs Seller has agreed to pay herein, Seller agrees to pay up to ____% of the Purchase Price OR up to $____ to be used only for Buyer’s loan costs, impounds, Title/Escrow Company costs, recording fees, and, if applicable, VA loan costs not permitted to be paid by Buyer.

Much of the discussion on seller concessions centers on the word prepaids which was removed and the addition of the language to be used only for.

Why was prepaids removed from the clause?

In the previous contract the word prepaids was loosely applied. Often when not all of the seller concessions were used after paying for loan costs, impounds, and title/escrow costs any remaining concessions would be used to perhaps prepay additional months of HOA, or maybe prepay pool service, etc. I have heard of seller concessions being applied to pay a buyer’s credit cards and buyer broker commission. While not all sellers may object to these applications, some vehemently did.

Most seller challenges as to what their concessions were to pay happen after receipt of the settlement statement, which is usually just days before a transaction is to close. When a seller and buyer cannot agree on the concessions, an addendum is often needed clarifying what may be paid before the transaction can close.

Since the new contract added the words to be used only for, questions that keep arising is if the lender is required one year of homeowner’s insurance and is the mortgage interest from the close of escrow to the first mortgage payment considered a loan cost? On March 28, 2017 AAR stated, “Both interest and the homeowner’s insurance premiums are costs that the lender requires to be paid as a condition to funding a loan. Thus, those items are considered to be loan costs as that term is used in Section 2j. Accordingly, the interest and homeowner’s insurance premiums would be included in the Seller Concessions as agreed by the parties.”

If there are remaining seller concessions may they be used to prepay items such as additional months of HOA or an additional year of home warranty? Probably not, since neither of these items is a loan cost or a condition to fund the loan.

Additional Seller Concessions are Negotiable

Just as all repairs are negotiable since the seller warranties were removed from the new Contract, the buyer may negotiate additional items that seller concessions may pay. A buyer may want to add language in the Additional Terms and Conditions section of the Contract to read something like this, “Seller concessions to be applied to the following items…”

Initial Appraisal Fee and Seller Concessions

Section 2m lines 111-113 read:

Initial appraisal fee shall be paid by __Buyer __Seller __Other at the time payment is required by lender and is non-refundable. If Seller is paying the initial appraisal fee, the fee __will __will not be applied against Seller’s Concessions at COE, if applicable.

Recently, a seller agreed to pay the initial appraisal fee of $500 to the lender at the beginning of the transaction. The $500 was to be applied against a seller concession of $4,000.

When the Closing Disclosure was sent to the seller it showed the seller’s concession at COE to be $4,000 instead of reducing it to $3,500, since the seller had already paid $500 for the appraisal.

Apparently, the lenders software was not able to show the seller paying the initial appraisal fee outside of escrow. The Closing Disclosure incorrectly showed that the buyer had paid it outside of escrow. Since the problem was found before closing it was resolved.

Conclusion

Most buyers think that when a seller agreed to give them a concession they will be able to use all of it. They do not understand all the nuances of its application. A buyer may consider adding language to the Contract, and they should discuss with their lender any limitations the lender may have with a seller concession.

Fletcher R. Wilcox is the author of The Wilcox Report and Vice President of Business Development for Grand Canyon Title. His market analysis has been referenced in the Wall Street Journal, Bloomberg News, HousingWire.com and National Mortgage News. He served on one of Arizona Association of Realtor’s 2017 Residential Resale Contract subcommittees. He may be reached at FWilcox@GCTA.com or by phone at 602-648-1230.

Who will be the top real agent, broker and more!

Old Town Scottsdale 2017 Friday Night Industry Party

Awards will be for

- Residential real estate agent of the year

- Residential real estate broker of the year

- Residential rookie agent of the year

- Residential team of the year

- Commercial managing principal of the year

- Commercial real estate broker of the year

- Home inspector of the year

- Certified appraiser of the year

- Escrow officer of the year

- Title sales representative of the year

- Mortgage loan originator of the year

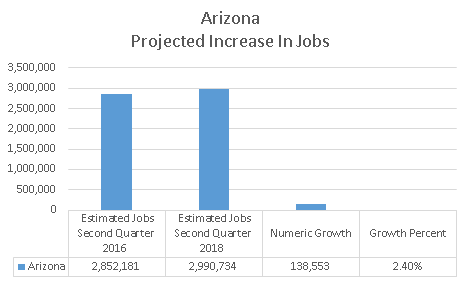

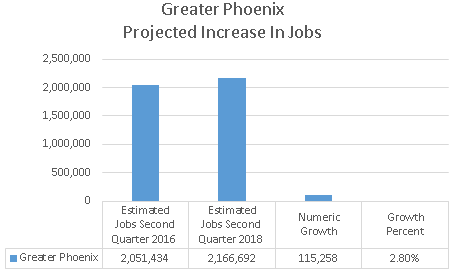

Arizona jobs projected to increase by 138,553 and Greater Phoenix jobs by 115,258. More jobs will keep the fire going for already hot housing market.

On March 9, the Arizona Office of Economic Opportunity released job projections. Jobs in Arizona are projected to increase by 138,553 from the Second Quarter of 2016 through the Second Quarter of 2018. The majority of the increase in jobs is expected to be in Greater Phoenix. Jobs in Greater Phoenix are projected to increase by 115,258. Greater Phoenix in this report is defined as Maricopa and Pinal counties.

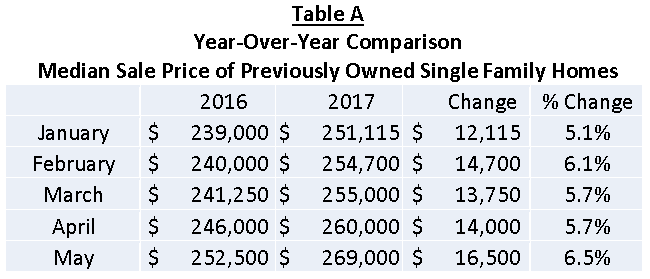

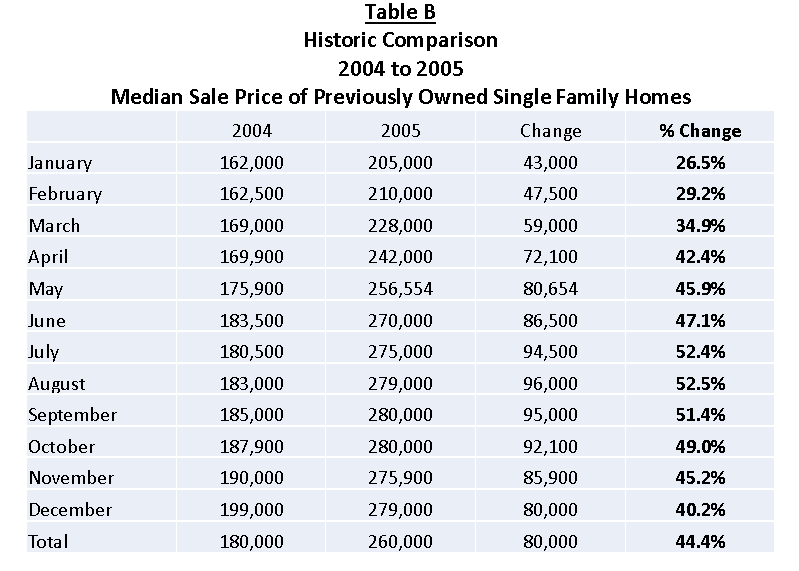

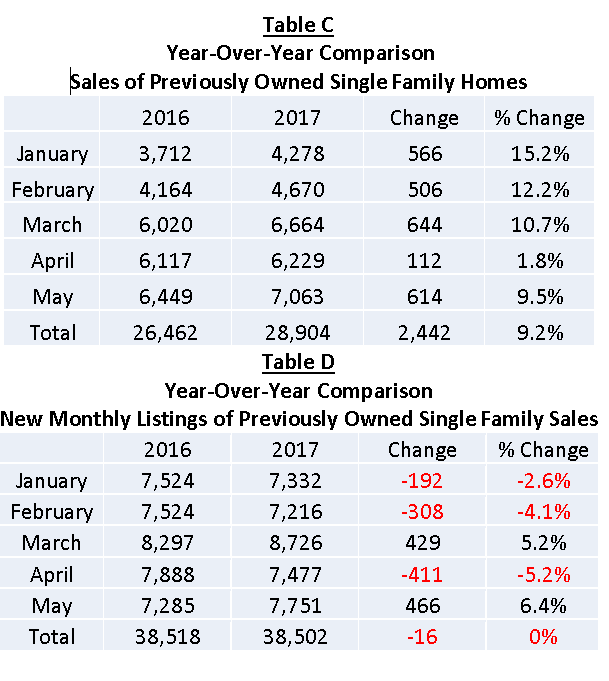

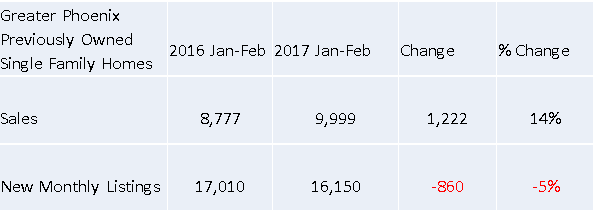

This increase in jobs, along with a growing population, will continue to fuel the demand for residential housing. Greater Phoenix is currently in the midst of a very hot demand for previously owned single family properties in many price ranges.

According to the Arizona Regional Multiple Listing Services, Inc., sales of previously owned single family homes in the first two months of 2017 are fourteen percent higher than for the same period last year. The number of sales in January and February 2017 were 9,999 compared to 8,777 for the same period last year.

While sales are up inventory is down. The number of previously owned new monthly listings in January and February 2017 were 5% or 860 less than for the same period last year.

When writing a contract, be prepared for your buyers to compete against multiple offers when a property is priced at market.

Expect prices to go up in many prices ranges.

The majority of the increase in jobs will be in Greater Phoenix

To read the report go to https://laborstats.az.gov/sites/default/files/documents/files/ST_IndProjReport.pdf

| 2016-2018 Projected Job Growth by Region | ||||

| Area Name | 2016 Estimated Total Employment Level | 2018 Projected Total Employment Level | Numeric Growth | Annualized Percentage Growth |

| Arizona | 2,852,181 | 2,990,734 | 138,553 | 2.4% |

| Phoenix MSA1 | 2,051,434 | 2,166,692 | 115,258 | 2.8% |

| Tucson MSA2 | 382,515 | 392,583 | 10,068 | 1.3% |

| Balance Of State3 | 414,363 | 427,176 | 12,813 | 1.5% |

| 1) Maricopa and Pinal Counties | ||||

| 2) Pima County | ||||

| 3) All other areas in Arizona less Maricopa, Pinal, and Pima Counties

Arizona’s industry employment projections are produced in conjunction with the U.S. Department of Labor (U.S. DOL), Employment and Training Administration (ETA). Fletcher R. Wilcox is V.P. of Business Development and a Real Estate Analyst at Grand Canyon Title Agency. He is author of www.TheWilcoxReport.com. His market analysis on residential real estate in Greater Phoenix has been mentioned in the Wall Street Journal, Bloomberg News, MarketWatch, HousingWire.com, National Mortgage News, Arizona Republic and the Phoenix Business Journal. He has been a guest speaker on local radio and both local and national TV. He teaches real estate agents strategies on marketing and instructs real estate classes in residential contract writing and Arizona title procedures. Fletcher started snowboarding in 2006. He is not very good. Fletcher may be reached at mailto:FWilcox@GCTA.com 602.648.1230 |

||||

Anticipatory Contract Writing

Published in the Arizona REALTOR’s Voice

by on September 9, 2016

There are 30 blank lines at the beginning of Section 8, Lines 311-340, Additional Terms and Conditions in the AAR Residential Resale Real Estate Purchase Contract (Contract). The purpose of these lines is for the buyer, before presenting an offer to the seller, to put in language that changes, adds to, or subtracts provisions in the body of the Contract.

The key to writing provisions language in the Additional Terms and Conditions section is to do so in clear and understandable terms. Knowledge of the Contract and its timelines is essential in constructing good language.

There are times when a buyer places language into the Additional Terms and Conditions Section in anticipation of situations that may occur in a transaction. The buyer wants the property. Emotions are high. This is when mistakes may be made. In the two scenarios below, a buyer makes the earnest money nonrefundable to present a better offer to the seller. Is the language clear and understandable?

You be the judge.

Scenario One

Language written in the Additional Terms and Conditions section reads, “Earnest money to be nonrefundable after ten day inspection period.”

On day seven after Contract acceptance, the Buyer’s Inspection Notice and Seller’s Response (BINSR) was delivered to the seller giving the seller the opportunity to correct five disapproved items. According to the Contract timeline, the seller then has five days to respond to the buyer. In this situation, the seller responded to the buyer on the fifth day, which was day twelve after contract acceptance. The seller checked the box on the BINSR stating, “Seller is unwilling or unable to correct any of the items disapproved by the Buyer.”

At the beginning of the transaction the buyer was hot for the property. Fifteen days later, upon receiving the seller’s response declining to fix the five requested items, the buyer’s emotions toward the property have cooled. The buyer then canceled the Contract and demanded a return of the earnest money. The seller argued that the buyer can cancel, but the buyer doesn’t get the earnest money, they do. Seller argued the 10 day inspection period ended when the BINSR was delivered and that the buyer canceled after this period. The buyer countered that the 10 day inspection period includes the entire buyer disapproval process in section 6J.

We have an escrow dispute. Is the language written in Section 8 clear and understandable?

Clearer language on behalf of the buyer addressing when the earnest money would be nonrefundable may be, “Buyer’s earnest money shall be nonrefundable unless Buyer elects to cancel pursuant to Section 6J.” Section 6J includes the BINSR timeframes for both buyer and seller responses.

Scenario Two

Language in the Additional Terms and Conditions section reads, “Earnest money to be nonrefundable and released to seller on the twenty first day after contract acceptance.” The buyer wanted 20 days for due diligence and was willing to make the earnest money nonrefundable after this time.

On day 21 after contract acceptance, the seller requested and received the earnest money from the escrow company. Fifteen days later when the close of escrow date came, the transaction did not close and could not close due to an I.R.S. lien attached to the property. For the transaction to close, the seller either had to have the lien paid at close of escrow or obtain a waiver from the I.R.S. The seller was unable to perform either. The buyer delivered a Cure Period Notice to the seller for seller’s failure to close escrow.

On the fourth day after delivery of the Cure Period Notice the seller was in breach, so the buyer canceled the transaction and demanded a return of the earnest money which, according to the language written in Section 8, was now in the seller’s possession.

Will the buyer be able to get the earnest money from the seller? Is the language written in Section 8 clear and understandable?

The buyer and their agent, in making the earnest money nonrefundable and released to the seller, did not anticipate what happens if the seller breaches the Contract. Clearer language on behalf of the buyer may be, “On the twenty first day after contract acceptance, earnest money shall be nonrefundable. However, in the event seller breaches the Contract, buyer is entitled to a return of the earnest money.”

Conclusion

Whether representing a seller or buyer, anticipatory contract writing is first thinking through possible scenarios that might arise based on the market or situation of the buyer, seller or home and addressing those situations with clear and understandable language. This type of writing is enhanced with a strong knowledge of the Contract and its timelines.

This article is not intended as legal advice. Consult your designated broker and legal counsel.

Fletcher R. Wilcox is V.P. of Business Development for Grand Canyon Title Agency. He teaches contract law renewal hours and is author of The Wilcox Report.

Fletcher R. Wilcox is V.P. of Business Development for Grand Canyon Title Agency. He teaches contract law renewal hours and is author of The Wilcox Report.What time of the year are there the most new listings and the most real estate sales? A review of the numbers in Greater Phoenix.

When are Real Estate Agents the Busiest?

By

Fletcher R. Wilcox

Grand Canyon Title Agency

Real estate agents make their commissions as listing agents and as selling agents. So at what times of the year are agents the busiest listing seller’s homes and closing on sales with buyers? What times of the year are listings and sales the slowest? Does real estate activity really slow down in the hot summer months?

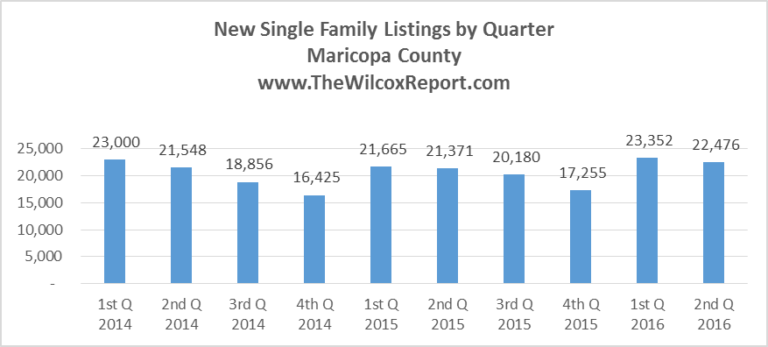

So, what I did was research the number of new listings and sales for existing single family homes in Maricopa County, Arizona. I broke down the years 2014, 2015 and the first half of 2016 into quarters. The data is from the Arizona Multiple Listing Services, Inc. (ARMLS).

The Findings

New Listings: Which Quarter Had the Most and the Least?

In both 2014, 2015 and in the first half of 2016 we saw the same pattern for new listings. The first quarter, the winter quarter, had the most new listings. Then like a stair step, the number of new listings declines in each of the following quarters with the fourth quarter having considerable less new listings than the first quarter. Then as the chart below shows, listings shoot up again in the first quarter of the New Year.

More New Listings and Sales in First-Half of 2016 Than in Either 2014 or 2015

When comparing the number of new listings in the first two quarters of 2016 there were 2,792 more new listings than 2015 and 1,280 than 2014. This increase in inventory along with job growth and population growth and boomerang buyers has fueled home ownership. There were 1,268 more sales in the first two quarters of 2016 than 2015 and a whopping 4,243 more sales than 2014.

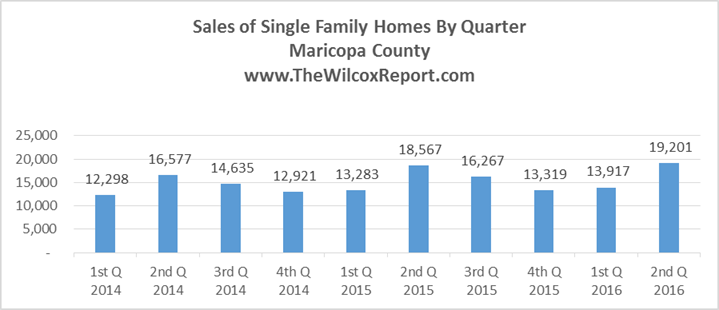

Sales: Which Quarter Had the Most and Least?

While the first quarter has the most new listings, the second quarter has the most sales. The chart below shows single family sales. In 2014, the quarter with the least number of sales was the first quarter. In 2015, it was a toss-up for the least number of sales between the first quarter and the fourth quarter. There were only thirty-six more closings in the fourth quarter over the first quarter. The second best quarter for sales has been the third quarter.

There are More Sales in the Hot Summer Months Than You Might Think

If we compare sales in the third quarter, the hot weather months of July, August and September, to the best quarter, the second quarter, we saw a decline in sales of 12% in both 2015 and 2014.

However, the third quarter has been the second best quarter for sales. In 2015, third quarter sales were 18% higher than in both the first and fourth quarters.

Conclusions

In recent history, the first and second quarters of the year had the most new listings followed by the second and third quarters as the most sales. While real estate sales slow-down in the hot weather third quarter compared to the spring second quarter, the third quarter has been the number two quarter for most sales. While sales in the first and fourth quarters are the slowest, there is still lots of sales activity. Data shows sales in the first and fourth quarters range between 12,000 and 14,000. Look for sales in the fourth quarter of 2016 to be over 14,000 sales.

Fletcher R. Wilcox is V.P. of Business Development and a Real Estate Analyst at Grand Canyon Title Agency.

He is author of www.TheWilcoxReport.com. His market analysis on residential real estate in Greater Phoenix has been mentioned in the Wall Street Journal, Bloomberg News, MarketWatch, HousingWire.com, National Mortgage News, Arizona Republic and the Phoenix Business Journal. He has been a guest speaker on local radio and both local and national TV.

He teaches real estate agents strategies in marketing and instructs real estate renewal classes in residential contract writing and Arizona title procedures. Fletcher started snowboarding in 2006. He is not very good.

Fletcher may be reached at FWilcox@GCTA.com 602.648.1230

Arizona Real Estate: Why more Canadians may sell their U.S. Properties in 2016

This article was first published in the Arizona REALTOR® Voice on March 8, 2016.

by on March 9, 2016

Many Canadians own residential real estate in Arizona. They are especially attracted to the desert areas of Arizona during the winter when they can soak in the sun rather than shake off the snow.

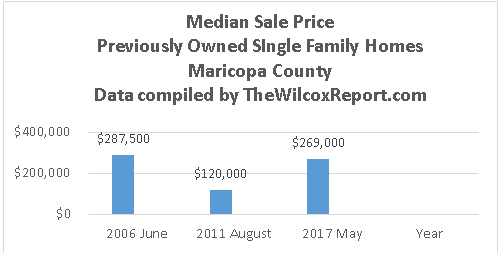

Many got spectacular deals purchasing residential properties when prices were low and the Canadian dollar was close to being on par with the U.S. dollar.

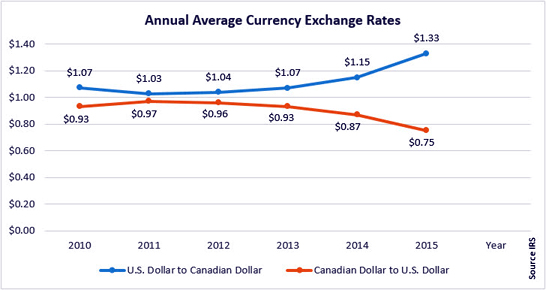

Changes in the Canadian economy and dollar make it likely that there are now fewer Canadian buyers, but more sellers of their U.S. properties. According to the Wall Street Journal on February 25, Canada’s economy is under pressure because of a drop in oil prices. In 2015, the Canadian-to-U.S. dollar average was at .75 cents compared to .97 cents in 2011.

Let’s look at a scenario as to why more Canadians may sell their U.S. properties this year than in recent years.

If a Canadian bought a house in the U.S. in 2011 and paid $150,000 USD, they would have paid close to $155,000 CAD. In 2015, if that same property, because of appreciation, sold for $225,000 USD, a Canadian seller would receive $300,000 CAD, almost double what they paid in Canadian dollars in 2011. Quite a gain. So far in 2016, the Canadian dollar is even weaker against the U.S. dollar than last year.

If a Canadian or if any foreigner, decides to sell their U.S. residential property, they should be aware of the Foreign Investment in Real Property Tax Act known as FIRPTA.

FIRPTA is the mandatory withholding of income tax on the disposition of U.S. real property interests by a foreign person(s) defined as a nonresident alien individual, a foreign corporation, a foreign partnership, trust or estate. According to the IRS, not only are sales under FIRPTA, but so are exchanges, gifts and transfers.

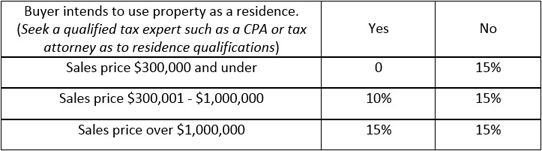

On February 17, the FIRPTA withholding tax rate increased up to 15% as demonstrated in the chart below:

According to FIRPTA, what is the buyer’s responsibility? A buyer is solely responsible for the FIRPTA withholding tax from a seller.

When the seller is a foreign person? The IRS states:

“In most cases, the transferee/buyer is the withholding agent. If you are the transferee/buyer you must find out if the transferor is a foreign person. If the transferor is a foreign person and you fail to withhold, you may be held liable for the tax.”

To help make buyers and sellers aware of FIRPTA, Arizona REALTORS® has addressed it in the Seller’s Property Disclosure Statement (SPDS) and Residential Resale Real Estate Purchase Contract (Resale Contract).

Lines 13 and 14 in the SPDS read:

“Is the legal owner(s) of the Property a foreign person or a non-resident alien pursuant to the Foreign Investment in Real Property Tax Act (FIRPTA)? Yes No. If yes, consult a tax advisor; mandatory withholding may apply.”Lines 135-138 in the Resale Contract read:

“IRS and FIRPTA reporting: Seller agrees to comply with IRS reporting requirements. If applicable, Seller agrees to complete, sign, and deliver to Escrow Company a certificate indicating whether Seller is a foreign person or non-resident alien pursuant to the Foreign Investment in Real Property Tax Act (“FIRPTA”). Buyer and Seller acknowledge that if the Seller is a foreign person, the Buyer must withhold a tax of up to 15% of the purchase price, unless an exemption applies.”

The seller in the Resale Contract agrees to comply with FIRPTA if they are a foreign person; if applicable, the buyer must withhold the tax. In the SPDS, the seller must indicate if they are a foreign person or non-resident alien; if they are, they should consult a tax advisor.

While different settlement agents may have different procedures, escrow officers are not equipped to give tax or legal advice concerning FIRPTA.

The IRS does not require the settlement agent to:

- Determine a seller’s status as a foreign person

- Decide how much FIRPTA tax should be withheld

- Decide if the seller qualifies for an exemption, or

- Complete FIRPTA forms

What then may a settlement agent do?

IF a buyer has determined that a seller owes FIRPTA tax, the escrow officer may assist them in collecting completed forms and withholding tax from the seller and buyer, and send the forms and taxes to the IRS on behalf of the seller and buyer. (Remember, there is no duty by the escrow officer to complete FIRPTA documents.)

IF a seller applies for an IRS certificate exempting or reducing FIRPTA withholding tax prior to the transaction closing, it is likely that the certificate from the IRS will not be received until post-closing. A settlement agent may agree to hold FIRPTA funds post-closing and send the funds to the IRS if certain conditions are met prior to the closing. If the required conditions are met, then both the buyer and seller will have to sign post-closing holdback instructions.

IF the requirements of a post-closing holdback are not met, the seller and buyer will have one of two options. The settlement agent may collect the proper forms and send in the withholding tax at the time of the closing. Or the seller and buyer mutually agree in writing that the FIRPTA funds may be transferred to an attorney or CPA’s trust account. The attorney or CPA will be responsible for the FIRPTA withholding amount.

Tips

If there is a FIRPTA withholding, both the seller and buyer will need either a social security number or a valid U.S. Individual Taxpayer Identification Number (ITIN) in order to process FIRPTA documents. If someone is not eligible for a social security number, they must apply for an ITIN.

Because of the length of time it may take to receive either a social security number or ITIN, it is a good idea to obtain one before a property is put on the market.

Also, talk with the escrow officer where the escrow will be processed prior to contract acceptance to find out what the officer will do on a FIRPTA transaction and what requirements must be met for a post-closing holdback.

A seller and buyer should always consult with a qualified CPA or tax attorney regarding FIRPTA.

Conclusion

In 2016, the Arizona real estate market will likely see more FIRPTA transactions with foreigners, specifically Canadians, selling their U.S. properties. A knowledge of FIRPTA by both the foreign seller and buyer will help ensure a smother closing.

Fletcher R. Wilcox is vice president of business development at Grand Canyon Title Agency

FWilcox@GCTA.com

602.648.1230

Phoenix Real Estate: Attend the first major real estate event of 2016! Why 2016 likely will be a better year for sales, guest speakers on closing trends and a special speaker from the CFPB!

Jim Sexton 2015 President Arizona Association of REALTORS and Fletcher R. Wilcox Grand Canyon Title invite you to attend the first major event in 2016 on residential closing trends you should know and obtain three C/E hours of contract law. We have put together an event which will bring you up to date on residential closings. Bring your questions, listen and learn. This is an Industry Partners Conference follow-up event. There will be a special guest speaker from the Consumer Financial Protection Bureau. See bio below!

Find out why it is likely there will be more residential sales in 2016 than 2015. (You have to see this!)

REGISTRATION DETAILS:

www.AARonline.com/event/E/TRIDFEB

Attend the class! TRID LIVE: Real Stories, Real Solutions. Three hours of C/E in contract law. February 4, 2016 | 8:00 a.m. to 1200 p.m. OrangeTree Golf Resort 10601 N. 56th Street, Scottsdale AZ 85254

Panel of designated brokers: Martha Appel, Coldwell Banker; Gerry Russell, Realty Executives, Laurie McDonnell, United Brokers Group

Panel of lenders: Sherry Olsen, Desert Schools Federal Credit Union, Matthew Kelchner, Suburban Mortgage

Panel of escrow officers: Leslie Banes, First American Title; Patti Shaw, Old Republic Title,

Moderators: Jim Sexton, 2015 AAR President and Fletcher R. Wilcox, Grand Canyon Title

Topics

- What can lenders provide buyers to strengthen their offers, in addition to the PQF?

- Is it taking longer to close under TRID? Yes, no, or sometimes?

- Triggers that might delay a closing.

- Are loan documents being signed three days before the close of escrow?

- Closings and FIRPTA. Do you know what the IRS says when there is a foreign seller?

- Are you seeing the buyer’s Closing Disclosure? The seller’s Closing Disclosure?

- When can agents review the settlement statement?

- Why are agents getting different settlement statements in their closing package?

- Do you have questions on the changes to the AAR Resale Contract, PQF, LSU and TRID?

- Special presentation on top ten ARMLS violations.

Noerena Limon from the Consumer Financial Protection Bureau (CFPB) will be our guest speaker. She is a policy analyst in the CFPB Office of Research Markets and Regulations and is the project lead for the Know Before You Owe, Closing Time Initiative. Throughout her 2-and-a-half years at the CFPB, Noerena has worked in the Office of Director Richard Cordray, the Office of Mortgage Markets and the Office of Liquidity Lending, focusing on mortgage and small dollar lending policy.

Phoenix Real Estate: What’s new? Webinar December 15 from 12:00 p.m to 1:00 p.m sponsored by the Arizona Association of REALTORS!

What’s new with real estate closings and TRID? Check out this webinar from the Arizona Association of REALTORS!

https://aar.uberflip.com/h/i/181800174-trid-part-3-12-15-15

Fletcher Wilcox, Grand Canyon Title Agency will be joining 2015 AAR President Jim Sexton to talk about the recent changes to residential closings. We will discuss financing, getting your buyers pre-approved, contract timelines, the settlement statement, changes to the AAR Resale Contract, TRID, and we will be taking your questions. Join us?

Jim Sexton Fletcher R. Wilcox

2015 President V.P. Business Development

Arizona Association of REALTORS Grand Canyon Title Agency

Designated Broker Realty One

Greater Phoenix Real Estate: What happened to all the distressed sales? October sales trends and estimated months of supply by price range.

Looking back five years

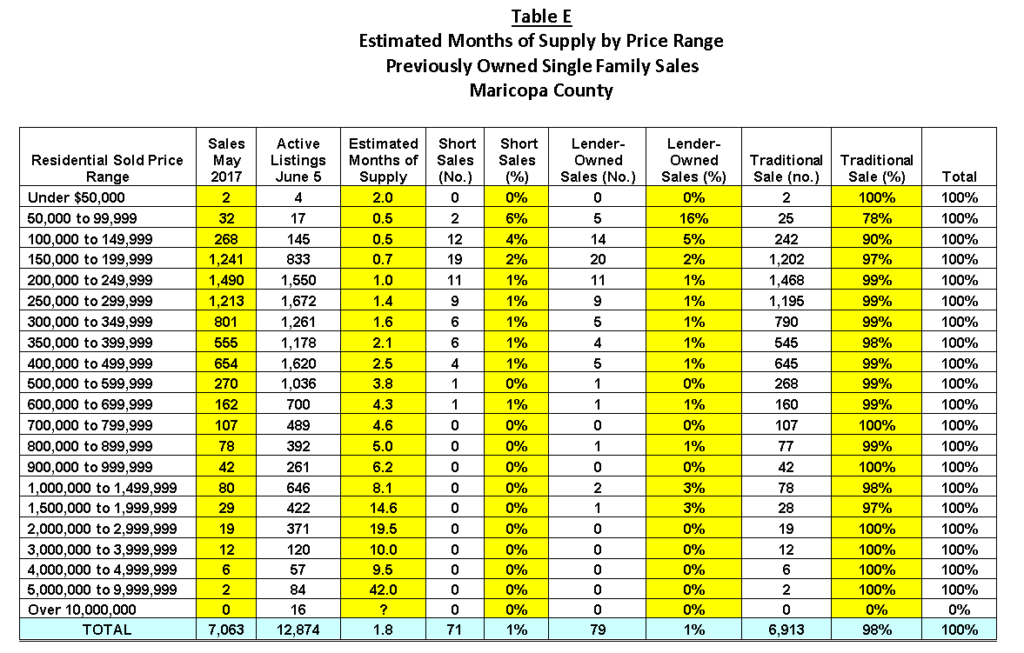

This report reviews existing single family home sale activity in Greater Phoenix. Greater Phoenix in this report is defined as Maricopa County.

In October 2011 distressed sales drove sales. In October 2011 66% of existing single family sales were distressed sales. In October 2015 distressed sales were 6% of existing single family sales.

The 6% or 267 distressed sales in October 2015 were categorized by 132 lender owned sales, 111 short sales and 24 HUD sales. Contrast this to October 2011 when there were 3,692 distressed sales made up of 1,843 lender owned sales, 1,590 short sales and 111 HUD sales.

Large numbers of distressed sales knocked down prices. October 2011 had 485 sales under $50,000 compared to 9 in October 2015. The median sales price of an existing single family home in October 2011 was $125,000. In October 2015 it was $236,000.

Don’t expect a sudden supply of distressed properties to hit the market any time soon. A major indicator of future distressed sales is foreclosure starts. According to NetValueCentral.com in October 2011 there were 3,623 foreclosure starts compared to 770 in October 2015. The all-time record for the most foreclosure notices filed in a single month in Maricopa County was March of 2009 when there were 9,052.

| Category | October 2011 | October 2015 | Change | % Change |

| Existing Sales | 5,625 | 4,619 | -1,006 | -18% |

| Distressed Sales | 3,692 | 267 | -3,425 | -93% |

| Lender Owned Sales | 1,843 | 132 | -1,711 | -93% |

| Short Sales | 1,590 | 111 | -1,479 | -93% |

| HUD Sales | 259 | 24 | -235 | -91% |

| Sales Under $50,000 | 485 | 9 | -476 | -98% |

| Foreclosures Notices | 3,623 | 770 | -2,853 | -79% |

| Median Sales Price | $125,000 | $236,000 | $111,000 | 89% |

October 2015 Existing Single Family Home Sales

Sales in October 2015 were slightly higher than in October 2014. Overall, sales for the first ten months of 2015 are 4,698 or 9.8% higher than sales compared to the same period last year.

New Monthly Listings

From January through May of 2015 there were 1,641 less new monthly listings compared to the same time period of last year. Then the June weather must have changed things. Starting in June 2015 through October, 1,853 more sellers put their single family homes on the market than for the same months in 2014.

October 2015 Estimated Months of Supply by Price Range

Sales under $300,000 were hot. The estimated months of supply for sales under $300,000 ranges from .8 months to 2.6 months. The table below shows the estimated months of supply by price range on November 18.

Short sales, lender owned sales and HUD sales made up six percent of existing single family sales in October. There were only 11 distressed sales over $500,000.

The most expensive home sale in October was a 33,000 square foot home that sold for $7,315,000 in Paradise Valley.

Is the existing single family market a buyer or seller market? Let’s answer this question from a supply and demand perspective. The general rule is that around six months inventory represents an equilibrium market between demand and supply or between seller and buyer. Below you can find the estimated months of supply by price range.

Fletcher R. Wilcox

V.P. Business Development

Real Estate Analyst

CFPB External Operations Expert

Grand Canyon Title Agency

A Division of FNTA

602.648.1230

Author of www.TheWilcoxReport.com

A report on real estate, lending and job growth trends in Greater Phoenix.

Grand Canyon Title Agency is a wholly owned subsidiary of the Fortune 314 company FNF.

Disclaimer

The information in this report may not be the opinion of Grand Canyon Title Agency.

While deemed accurate this report does not guarantee the accuracy of the data. Some numbers will change. Report may not reflect all real estate activity. Information should be verified. This article is of a general nature, and is not intended as investment advice, real estate advice, lending advice or legal advice. Please consult your broker, your lender, your own independent legal counsel, your certified public accountant.

Note: Included in some of the charts in this report may be a small number of new home sales.

Follow Fletcher