Record First Quarter Due to Population, Job and Wage Increases.

May 18, 2018 By

May 2018

Residential Market Update

Published in Arizona Journal of Real Estate & Business

Fletcher R. Wilcox

Fletcher R. Wilcox is the author of TheWilcoxReport.com. He is V. P. of Business Development and a Real Estate Analyst for Grand Canyon Title Agency. Fletcher can be reached at FWilcox@GCTA.com and 602.648.1230.

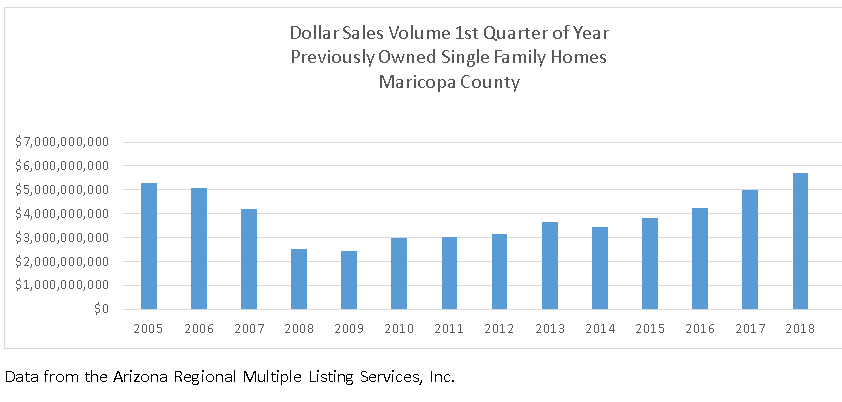

2018 Dollar Sales Volume Hits All-Time High for a First Quarter

Strong demand to own a home in the first quarter of 2018 led to the highest dollar sales volume ever for a first quarter. The previous first quarter with the highest dollar sales volume was in 2005. First quarter dollar sales volume for both 2005 and 2018 was over five billion dollars with 2018 being 445 million higher than 2005. Dollar sales volume measures the strength or weakness of a market. It is comprised by adding the sale price of each sale for a total. The dollar sales volume in this report is for previously owned single family home sales in Maricopa County. Previously owned single family home sales are eighty percent of residential sales making it the most popular residential product for buyers.

When comparing first quarter 2018 to first quarter 2017 there were 16,227 sales in 2018 which was four percent higher than the 15,602 sales in 2017. The median sale price in first quarter 2018 was $277,000 compared to $255,000 in 2017 for a five percent increase.

Demand to Own Fueled by Population, Job and Wage Growth

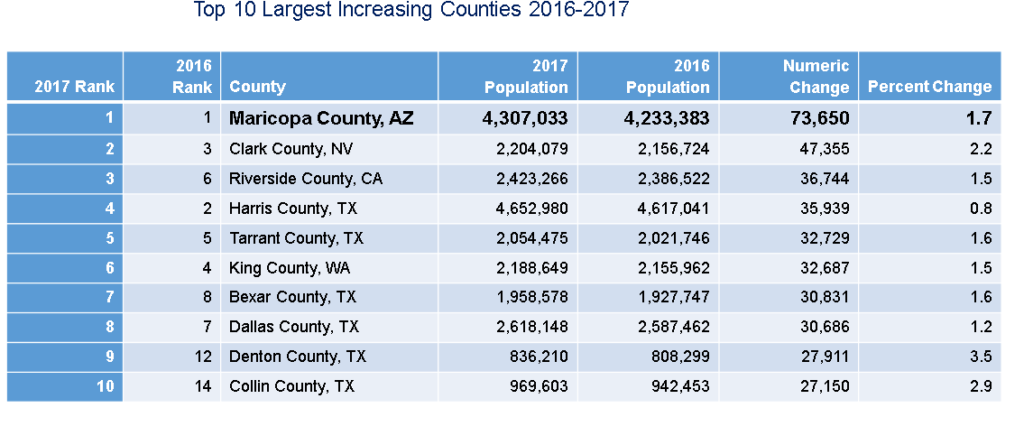

Population Growth: According to the U.S. Census Bureau Maricopa County for the second year in a row was ranked the number one county with the greatest increase in population. The population of Maricopa County increased by 73,650 in the 2017 rankings, or 202 people a day. Finishing second was Clark County, Nevada with a population increase of 47,355 or 130 per day.

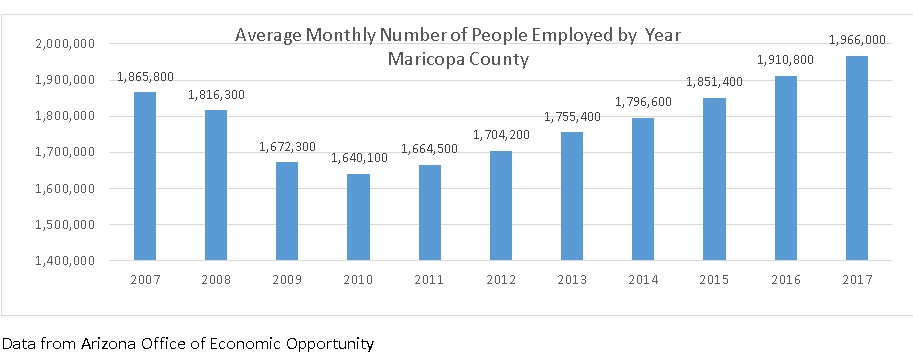

Job Growth: In 2007 there were 1,865,800 people employed in Maricopa County. Three years later in 2010 – there were 225,700 less people working. Back then many people that lost their jobs stopped making their mortgage payments. Mortgage payments not made lead to foreclosure notices. Foreclosures notices lead to cheap REO sales driving down home values. This is far from the situation today. In 2017 there were 325,900 more people employed than in 2010. With a growing number of employed people, and since everyone has to live somewhere, the sheer number of employed people creates a lot of competition for existing inventory. Prediction: By the end of 2018, the average monthly number of people employed will be over 2,000,000 per month for the first-time!

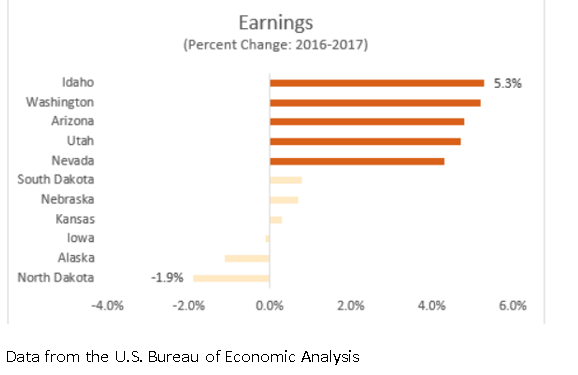

Rising Wages: At the time of writing this article only wage information for Arizona was available. Maricopa County which is located in Arizona has seventy-one percent of all employed workers in the state. According to the U.S. Bureau of Economic Analysis the average state earnings for the fifty states increased 3.1% in 2017. Earnings are defined as wages and salaries. Arizona earnings were above average. Arizona had the third highest earnings at 4.8 percent, behind only Idaho and Washington. Leading Arizona’s earnings was healthcare with an increase of 6.4 percent.

Conclusion

There is a lot of news that positively affects the Maricopa County real estate market. Population, job and wage growth should continue to increase. These increases will keep the fierce competition amongst buyers for single family homes at the most popular price ranges. Also, because of the sheer dollar sales volume of the market, expect increased competition amongst real estate companies as more of them, some with new business models, enter our market for a piece of the dollar action. I do expect 2018 will end as one of the best years ever for the Maricopa County real estate market.

Fletcher R. Wilcox

Fletcher R. Wilcox is the author of TheWilcoxReport.com. He is V. P. of Business Development and a Real Estate Analyst for Grand Canyon Title Agency. Fletcher can be reached at FWilcox@GCTA.com and 602.648.1230.

2018 New Tax Law: How it affects Sellers, Buyers and REALTORS!

January 22, 2018 By

Learn about the New Tax Law!

When: January 25 from 10:00 a.m. to 12:00 p.m.

Where: 10300 N. 79th Way, Scottsdale, 85258 Class will be in a brand new $2,000,000 staged luxury home by Cachet Homes.

One block south of Shea Blvd., turn on Gold Dust just west of Hayden Road.

DO NOT GOOGLE ADDRESS — IT WILL TAKE YOU TO THE WRONG LOCATION!

RSVP to Fwilcox@GCTA.com 602.648.1230

A Class on Social Influence & the Psychology of Persuasion when Working with Sellers & Buyers

November 2, 2017 By

A Class on

Social Influence & the Psychology of Persuasion

Create influence with buyers & sellers

Turn numbers into knowledge

Turn knowledge into authority

Review social psychology and persuasion

How to get your happy clients to spread the word about you

Get more referral business in 2018!

JOIN US:

Thursday, November 9th 11:30am to 1:00pm (lunch provided)

LOCATION:

10958 E. TAOS DR, SCOTTSDALE, AZ. 85262

Class will be held in a Luxury Listing Presented by: Yvonne Faustinos, Russ Lyon Sotheby’s International Realty

RSVP: mailto:FWilcox@gcta.com or 602.648.1230

The Presenter: Fletcher R. Wilcox is V.P. of Business Development and a Real Estate Analyst at Grand Canyon Title. He is founder of The Wilcox Report. His market analysis on the Greater Phoenix residential real estate market has been referenced in the Wall Street Journal, Bloomberg News, MarketWatch, National Mortgage News, Housing Wire.com..and on local and national T.V. Fletcher teaches residential contract writing for renewal hours and served on one of the three Arizona Association of REALTORS subcommittees for the February 2017 AAR Residential Resale Real Estate Purchase Contract.

Sponsors

Mathew Kelchner Ron Peters Yvonne Faustinos

Suburban Mortgage Alta Vista Inspection Services REALTOR

Branch Manager Exclusive 100-Day Inspection Guarantee Russ Lyon Sotheby’s International Realty

NMLS215995

602.758.3459 480.816.8552 480.580.4524

West Valley Real Estate Event: Predictions for 2018 & How to Use Market Data With Your Clients & Appraisal Q & A!

October 24, 2017 By

West Valley Real Estate Event

Wednesday, November 1, 2017 from 10:30 a.m. to 12:00 p.m.

-

Predictions for 2018

-

How to use market data for credibility with your clients

-

2017 real estate trends for sales, new listings, estimated months of supply

-

Compare home prices today and before the real estate recession

-

What month of the year has the highest sale price?

-

Appraisals and home values

-

What can you say to an appraiser?

-

What have you always wanted to ask an appraiser?

-

How much does solar increase value?

-

Bring your questions

Where: Cachet at the Wigwam

14200 W Village Pkwy #2256 Litchfield Park, AZ 85340

Realtors will tour Cachet’s beautiful single family homes, townhomes and condos.

Lunch served at 12:00 p.m.

RSVP to FWilcox@GCTA.com or 602.648.1230

Speakers

Fletcher R. Wilcox is V.P. of Business Development and a Real Estate Analyst at Grand Canyon Title. He grew up in Phoenix. Graduated from A.S.U. He is author of The Wilcox Report. His market analysis on the Greater Phoenix residential real estate market has been mentioned in the Wall Street Journal, Bloomberg News, MarketWatch, National Mortgage News, Housing Wire.com. Fletcher teaches residential contract writing for renewal hours and served on one of the three Arizona Association of REALTORS subcommittees for the February 2017 AAR Residential Resale Real Estate Purchase Contract.

Robert Oglesby is the Founder, President, and Chief Appraiser of AppraisalTek, a full service appraisal company that has established a reputation for providing high-quality appraisal services. Robert supervises all appraisal management operations for multiple large mortgage bankers and his company processes a high volume of appraisals every month. Robert employs and manages full-time employees, including staff appraisers and independent contractors. Robert is a LEED Green Associate, and active certified appraiser. In addition to his work at AppraisalTek, Robert organizes and presents professional seminars for real estate professionals.

Sponsor

Home Prices Keep Going Up in Greater Phoenix!

June 28, 2017 By

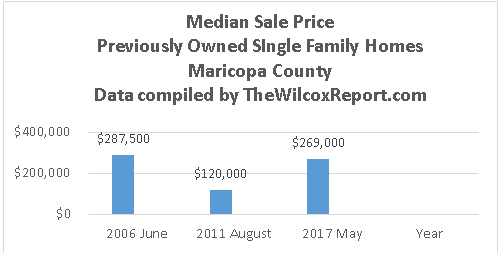

It has been a long time since the median sale price for a previously owned single family home was this high.

May 2017 Results

The median sale price for a previously owned single family home in May was $269,000. The last time the sale price was at the $269,000 level was almost ten years ago. It was August of 2007.

The data in this report was compiled from the Arizona Regional Multiple Listing Services, Inc. The geographic area is Greater Phoenix (Maricopa County).

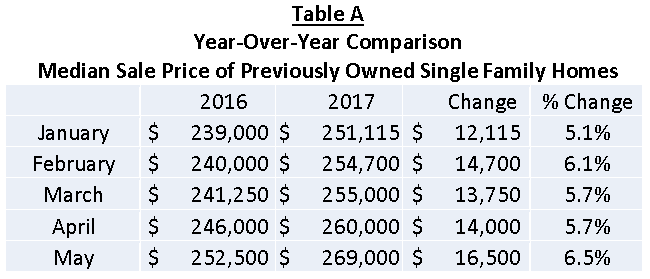

The May 2017 median sale price represented a year-over-year increase of 6.5% or $16,500 compared to May 2016 when it was $252,500. This is a healthy increase. See Table A.

A Brief History of Median Sale Price

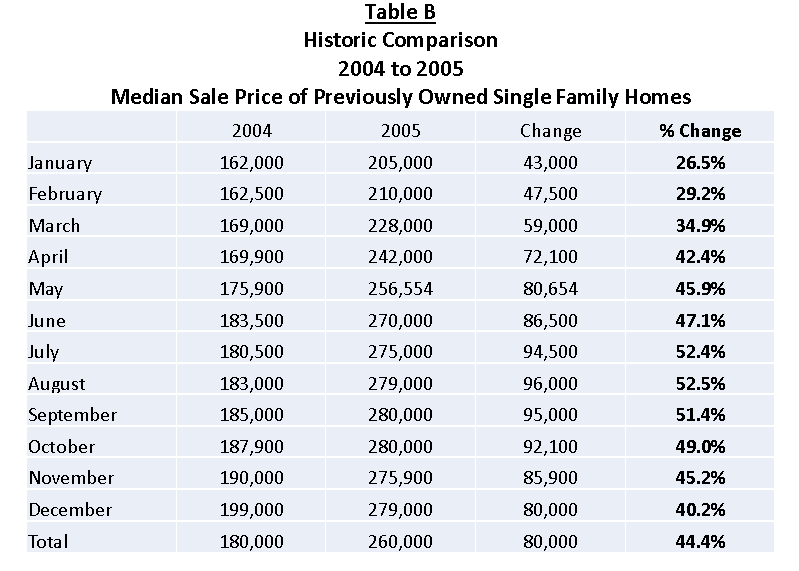

The first time in Maricopa County history that the median sale price of a previously owned single family home reached the May 2017 level was in June 2005. Back then the year-over-year increase was not 6.5% or even close. It was 47.1% or $86,500. It went from $183,500 in June 2004 to $270,000 in June 2005. See Table B.

The May median sale price of $269,000 has come a long way since August 2011 when it bottomed at $120,000. But it still has a little way to go to reach the peak month of $287,500 in June 2006.

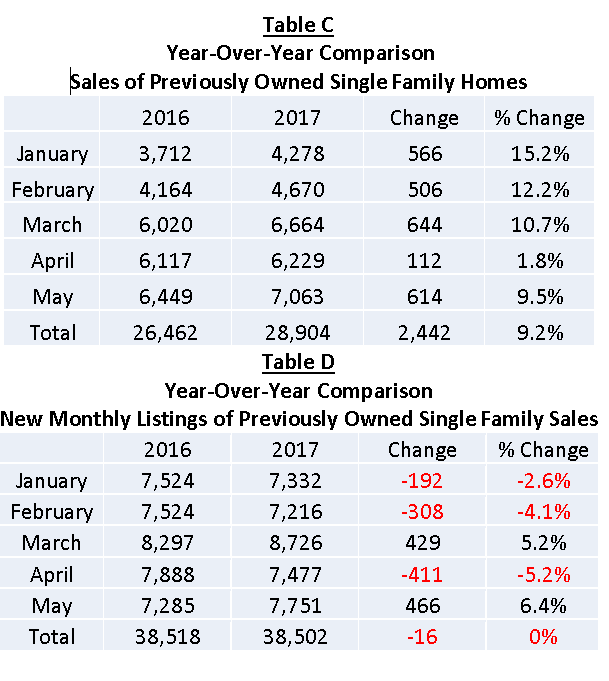

Sales in May 2017

May 2017 sales were up 9.5% or by 614 compared to May 2016. Additionally, May 2017 sales were up 13.3% or by 834 over April 2017. Compare this to May 2016 sales which were up 5.4% or by 332 over April 2016. See Table C.

New Monthly Listings in May 2017

May 2017 new monthly listings had the highest year-over-year increase for a month this year. There were 466 more listings that hit the market this May than last May. This jump in inventory most likely will help keep up sales momentum in June and July.

Overall, the number of new monthly listings is flat when comparing the number for the first five months of 2017 to 2016. See total in Table D.

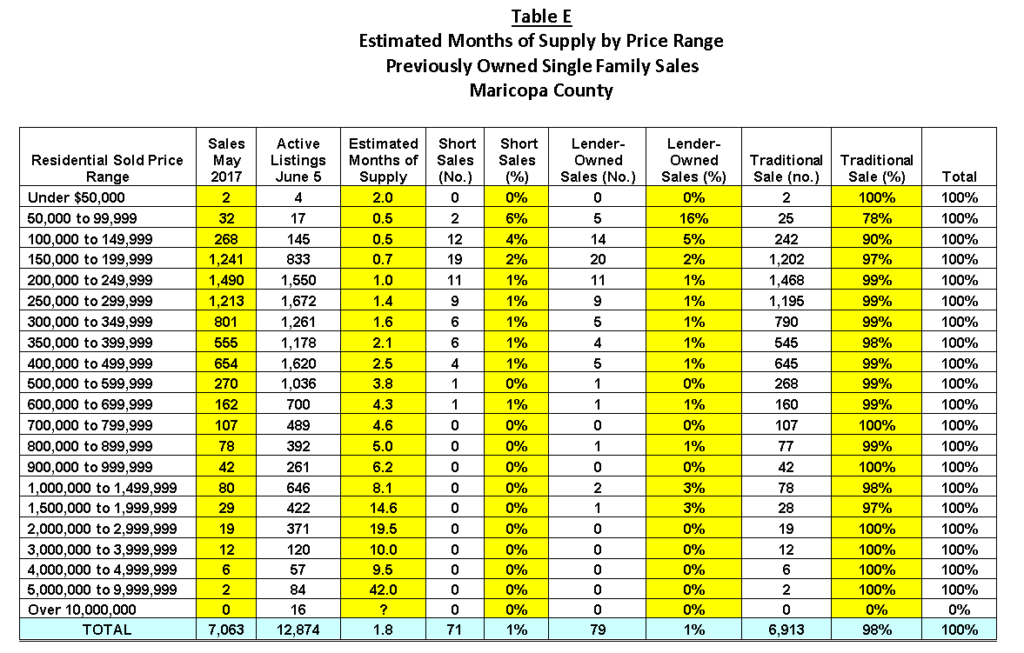

Estimated Months of Supply by Price Point

It is a seller’s market for homes priced under $600,000 (as long as they are priced right). For all price points under $600,000 the estimated months of supply is under four months. The price range with the highest number of sales was $200,000 to $249,999. The estimated months of supply in this range was one month. See Table E.

Fletcher R. Wilcox is V.P. of Business Development and a Real Estate Analyst at Grand Canyon Title Agency.

He is author of www.TheWilcoxReport.com. His market analysis on residential real estate in Greater Phoenix has been referenced in the Phoenix Business Journal, the Wall Street Journal, Bloomberg News, MarketWatch, HousingWire.com, National Mortgage News, and the Arizona Republic. He has been a guest speaker on local radio and both local and national TV.

He teaches real estate agents marketing strategies and teaches residential contract writing and Arizona title procedures. He served on one of the subcommittees at the Arizona Association of REALTORS subcommittees making recommendations on changes to the February 2017 AAR Residential Resale Real Estate Purchase Contract. Fletcher started snowboarding in 2006. He is not very good. Fletcher may be reached at FWilcox@GCTA.com 602.648.1230

Real Estate Agents: Contract law class in beautiful new construction luxury home in Heart of Scottsdale!

June 9, 2017 By

June 22, 9:30 a.m. to 1:00 p.m.

Contract to Closing: Contingencies, Clauses and Cures for three hours of contract law.

Enjoy the class in a brand new luxury home in the Heart of Scottsdale. The home is approximately 4,341 square feet priced at $1,820,000. Tour the home at 9:30 a.m. and meet the builder. Class is from 10:00 a.m. to 1:00 p.m.

Fox Haven by Cachet Homes

Class location: 10332 N. 79th Way, Scottsdale, 85258 (Hayden and Gold Dust, just south of Shea Blvd.)

MUST RSVP FWilcox@GCTA.com or 602.648.1230 Cost is ($10.00) dollars.

Class by Internal Dynamics School of Real Estate 13565 N. 102nd Place, Scottsdale 85260 602.363.2960 mbarnewolt@msn.com

We will use real life scenarios involving the AAR Residential Resale Real Estate Purchase Contract.

Scenarios

Inspection period

BINSR

Seller concessions

Release of earnest money

Risk of loss clause

Contingency clauses versus promise clauses

When do I deliver a cure period notice

Breach of contract

Commitment for title

What is FIRPTA?

There will be a review of the contract timelines

p.s. I served on one of the subcommittees at the Arizona Association of REALTORS which made the changes to the new contract released February 2017.

Fletcher R. Wilcox

Contact me to open your next escrow with our Scottsdale office located at 8520 E. Shea Blvd., Suite 115, 85260.

Fletcher R. Wilcox is the author of The Wilcox Report and Vice President of Business Development for Grand Canyon Title. His market analysis has been referenced in the Wall Street Journal, Bloomberg News, HousingWire.com and National Mortgage News. He served on one of Arizona Association of Realtor’s 2017 Residential Resale Contract subcommittees. He may be reached at FWilcox@GCTA.com or by phone at 602-648-1230.

Recent media appearances

May 17, 2017 in the Phoenix Business Journal http://www.bizjournals.com/phoenix/news/2017/05/11/existing-home-sales-highest-since-2006-up-18-over.html

May 12, 2017 KTAR https://ktar.com/story/1570668/maricopa-county-home-sales-up-18-percent-near-prerecession-numbers/

Television interviews

My interview with Gerri Willis on the Fox Business News Network

Interview with Jim Belfiore on Square Off Arizona. Topic: The President and Housing.

Interview on Horizon on housing market.

Scottsdale Report: Residential Real Estate Trends for April 2017. Estimated months of supply for single family homes and more!

May 23, 2017 By

This report is on Scottsdale sales and new listing trends for single family, apartment style, townhouse and patio homes.

The data was compiled from the Arizona Regional Multiple Listing Services, Inc. (ARMLS).

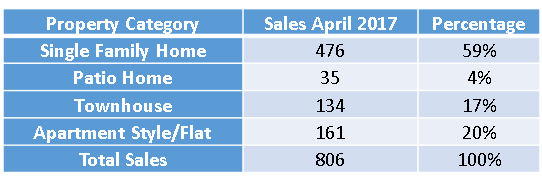

In April, of the four residential categories, single family homes had the most sales at 476 or 59% of all sales. Second was Apartment Style / Flat homes with 161 sales.

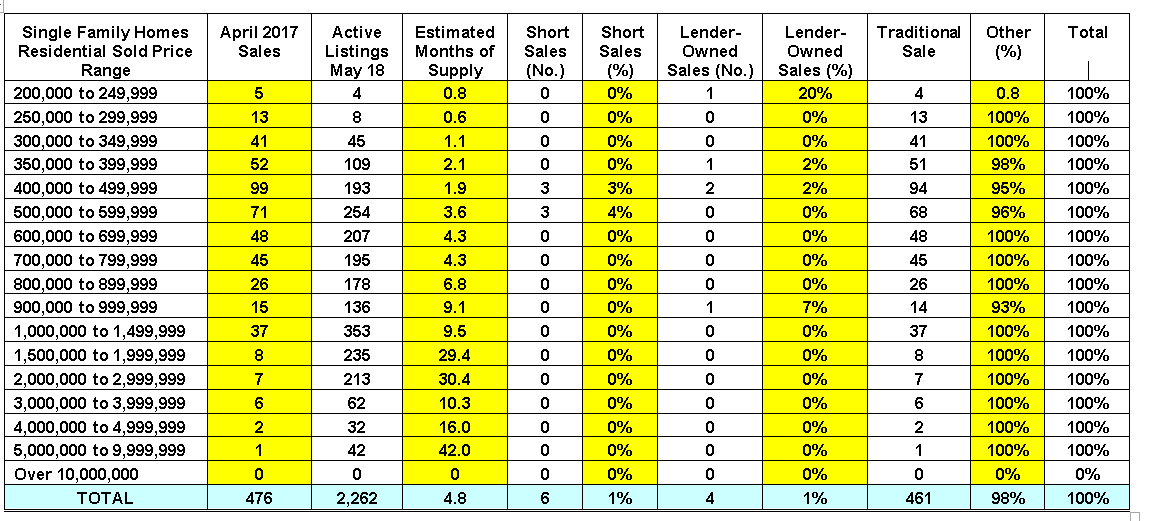

Single Family Homes Estimated Months of Supply by Price Range

As can be seen in the table, homes in the lower price ranges generally have lower estimated months of supply. Generally when there is a four month of supply or less it is considered a seller’s market. Out of the 476 sales only ten were either a short sale or lender-owned sale.

April 2017

As can be seen, sales in three of the four categories were up this April over last April. Townhouse sales had the greatest increase at 34%, while single family sales were down 4%. Even though single family homes were down this April compared to last April, single family home sales are up ten percent for the first four months of 2017 (see the table below in the section Sales and New Listing Trends for the First Four Months of 2017).

How did new monthly listings for the four categories compare in April 2017 to April 2016?

There were less new monthly listings in each of the four residential categories this April compared to last April.

Sales and New Listing Trends for the First Four Months of 2017

Below enter your email address to subscribe to this blog and receive notifications of new updates to The Wilcox Report by email.

Contact me to open your next escrow with our Scottsdale office located at 8520 E. Shea Blvd., Suite 115, 85260.

Fletcher R. Wilcox is the author of The Wilcox Report and Vice President of Business Development for Grand Canyon Title. His market analysis has been referenced in the Wall Street Journal, Bloomberg News, HousingWire.com and National Mortgage News. He served on one of Arizona Association of Realtor’s 2017 Residential Resale Contract subcommittees. He may be reached at FWilcox@GCTA.com or by phone at 602-648-1230.

Recent media appearances

May 17, 2017 in the Phoenix Business Journal http://www.bizjournals.com/phoenix/news/2017/05/11/existing-home-sales-highest-since-2006-up-18-over.html

May 12, 2017 KTAR https://ktar.com/story/1570668/maricopa-county-home-sales-up-18-percent-near-prerecession-numbers/

Television interviews

My interview with Gerri Willis on the Fox Business News Network

Interview with Jim Belfiore on Square Off Arizona. Topic: The President and Housing.

Interview on Horizon on housing market.

First Quarter 2017: Residential Sales Volume Highest in Eleven Years!

May 10, 2017 By

First Quarter 2017 Results

Previously Owned Single Family Homes

Maricopa County

Data compiled from the Arizona Regional Multiple Listing Services, Inc.

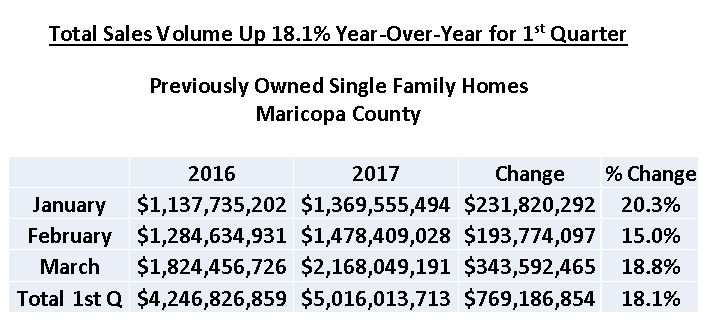

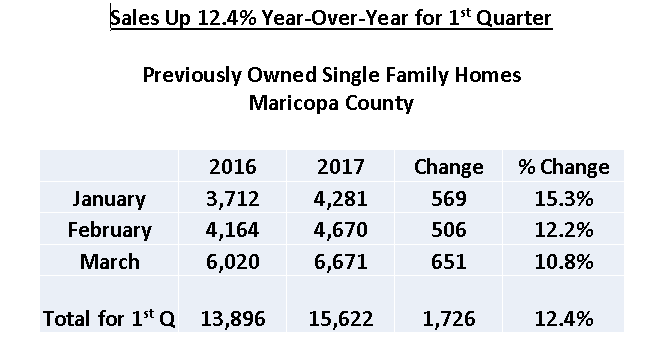

Sales volume in the first quarter of 2017 was the highest since 2006, which was before the great real estate recession. First quarter 2017 sales volume was 18.1% higher than the first quarter of 2016.

Sales volume for this report is the total of the sale prices for previously owned single family homes. An example of sales volume would if a real estate agents sold 20 homes and the sales price for each home was $250,000 their sales volume would be $5,000,000.

Sales volume is a health indicator of a real estate market. It not only speaks on the number of sales, but also on their sale price. It may show if prices are decreasing, flat, or increasing. For example, in the first quarter of 2017 there were 15,622 sales for a sales volume of $5,016,013,713. The average or mean sale price was $321,086. Compare this to first quarter of 2012 when there were more sales, 16,405, but sales volume was lower, $3,144,327,127. The average sale price then was $191,668.

The 2017 first quarter average sale price of $321,086 was $15,471 or 5% higher than the first quarter of 2016 average of $305,615.

A Formula for Price Increases

While sales were up 12.4% in the first quarter of 2017 year-over-year, new inventory was flat. There were 1,726 more sales and 81 less new listings.

If the trend of more sales and less inventory continues prices will go up in the price ranges with heavy demand.

Coming soon will be the estimated months of supply by price range.

Below enter your email address to subscribe to this blog and receive notifications of new updates to The Wilcox Report by email.

Open your next escrow with our Scottsdale office located at 8520 E. Shea Blvd., Suite 115, 85260.

Fletcher R. Wilcox is the author of The Wilcox Report and Vice President of Business Development for Grand Canyon Title. His market analysis has been referenced in the Wall Street Journal, Bloomberg News, HousingWire.com and National Mortgage News. He served on one of Arizona Association of Realtor’s 2017 Residential Resale Contract subcommittees. He may be reached at FWilcox@GCTA.com or by phone at 602-648-1230.

Television interviews

My interview with Gerri Willis on the Fox Business News Network

Interview with Jim Belfiore on Square Off Arizona. Topic: The President and Housing.

Interview on Horizon on housing market.

Which buyer costs can a seller concession now pay?

May 8, 2017 By

Sixty Days Later: The New AAR Purchase Contract

Published May 2, 2017 in the Arizona Journal of Real Estate & Business

http://www.asreb.com/2017/05/sixty-days-later-the-new-aar-purchase-contract/

By

Fletcher R. Wilcox

The Wilcox Report

Grand Canyon Title Agency

As I write this article, it is sixty days since the introduction of the new AAR Residential Resale Real Estate Purchase Contract on February 1, 2017. I will review the change in seller concessions, which is a hot topic, and touch on something that recently happened when a seller agreed to pay the initial appraisal fee — and it was to be included in the seller concessions.

The Seller Concessions clause in the new AAR Contract reads:

2J. Seller Concessions (if any): In addition to the other costs Seller has agreed to pay herein, Seller agrees to pay up to ____% of the Purchase Price OR up to $____ to be used only for Buyer’s loan costs, impounds, Title/Escrow Company costs, recording fees, and, if applicable, VA loan costs not permitted to be paid by Buyer.

Much of the discussion on seller concessions centers on the word prepaids which was removed and the addition of the language to be used only for.

Why was prepaids removed from the clause?

In the previous contract the word prepaids was loosely applied. Often when not all of the seller concessions were used after paying for loan costs, impounds, and title/escrow costs any remaining concessions would be used to perhaps prepay additional months of HOA, or maybe prepay pool service, etc. I have heard of seller concessions being applied to pay a buyer’s credit cards and buyer broker commission. While not all sellers may object to these applications, some vehemently did.

Most seller challenges as to what their concessions were to pay happen after receipt of the settlement statement, which is usually just days before a transaction is to close. When a seller and buyer cannot agree on the concessions, an addendum is often needed clarifying what may be paid before the transaction can close.

Since the new contract added the words to be used only for, questions that keep arising is if the lender is required one year of homeowner’s insurance and is the mortgage interest from the close of escrow to the first mortgage payment considered a loan cost? On March 28, 2017 AAR stated, “Both interest and the homeowner’s insurance premiums are costs that the lender requires to be paid as a condition to funding a loan. Thus, those items are considered to be loan costs as that term is used in Section 2j. Accordingly, the interest and homeowner’s insurance premiums would be included in the Seller Concessions as agreed by the parties.”

If there are remaining seller concessions may they be used to prepay items such as additional months of HOA or an additional year of home warranty? Probably not, since neither of these items is a loan cost or a condition to fund the loan.

Additional Seller Concessions are Negotiable

Just as all repairs are negotiable since the seller warranties were removed from the new Contract, the buyer may negotiate additional items that seller concessions may pay. A buyer may want to add language in the Additional Terms and Conditions section of the Contract to read something like this, “Seller concessions to be applied to the following items…”

Initial Appraisal Fee and Seller Concessions

Section 2m lines 111-113 read:

Initial appraisal fee shall be paid by __Buyer __Seller __Other at the time payment is required by lender and is non-refundable. If Seller is paying the initial appraisal fee, the fee __will __will not be applied against Seller’s Concessions at COE, if applicable.

Recently, a seller agreed to pay the initial appraisal fee of $500 to the lender at the beginning of the transaction. The $500 was to be applied against a seller concession of $4,000.

When the Closing Disclosure was sent to the seller it showed the seller’s concession at COE to be $4,000 instead of reducing it to $3,500, since the seller had already paid $500 for the appraisal.

Apparently, the lenders software was not able to show the seller paying the initial appraisal fee outside of escrow. The Closing Disclosure incorrectly showed that the buyer had paid it outside of escrow. Since the problem was found before closing it was resolved.

Conclusion

Most buyers think that when a seller agreed to give them a concession they will be able to use all of it. They do not understand all the nuances of its application. A buyer may consider adding language to the Contract, and they should discuss with their lender any limitations the lender may have with a seller concession.

Fletcher R. Wilcox is the author of The Wilcox Report and Vice President of Business Development for Grand Canyon Title. His market analysis has been referenced in the Wall Street Journal, Bloomberg News, HousingWire.com and National Mortgage News. He served on one of Arizona Association of Realtor’s 2017 Residential Resale Contract subcommittees. He may be reached at FWilcox@GCTA.com or by phone at 602-648-1230.

Follow Fletcher