Sixty Days Later: The New AAR Purchase Contract

Published May 2, 2017 in the Arizona Journal of Real Estate & Business

http://www.asreb.com/2017/05/sixty-days-later-the-new-aar-purchase-contract/

By

Fletcher R. Wilcox

The Wilcox Report

Grand Canyon Title Agency

As I write this article, it is sixty days since the introduction of the new AAR Residential Resale Real Estate Purchase Contract on February 1, 2017. I will review the change in seller concessions, which is a hot topic, and touch on something that recently happened when a seller agreed to pay the initial appraisal fee — and it was to be included in the seller concessions.

The Seller Concessions clause in the new AAR Contract reads:

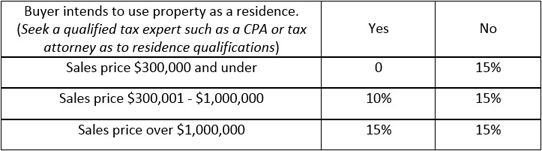

2J. Seller Concessions (if any): In addition to the other costs Seller has agreed to pay herein, Seller agrees to pay up to ____% of the Purchase Price OR up to $____ to be used only for Buyer’s loan costs, impounds, Title/Escrow Company costs, recording fees, and, if applicable, VA loan costs not permitted to be paid by Buyer.

Much of the discussion on seller concessions centers on the word prepaids which was removed and the addition of the language to be used only for.

Why was prepaids removed from the clause?

In the previous contract the word prepaids was loosely applied. Often when not all of the seller concessions were used after paying for loan costs, impounds, and title/escrow costs any remaining concessions would be used to perhaps prepay additional months of HOA, or maybe prepay pool service, etc. I have heard of seller concessions being applied to pay a buyer’s credit cards and buyer broker commission. While not all sellers may object to these applications, some vehemently did.

Most seller challenges as to what their concessions were to pay happen after receipt of the settlement statement, which is usually just days before a transaction is to close. When a seller and buyer cannot agree on the concessions, an addendum is often needed clarifying what may be paid before the transaction can close.

Since the new contract added the words to be used only for, questions that keep arising is if the lender is required one year of homeowner’s insurance and is the mortgage interest from the close of escrow to the first mortgage payment considered a loan cost? On March 28, 2017 AAR stated, “Both interest and the homeowner’s insurance premiums are costs that the lender requires to be paid as a condition to funding a loan. Thus, those items are considered to be loan costs as that term is used in Section 2j. Accordingly, the interest and homeowner’s insurance premiums would be included in the Seller Concessions as agreed by the parties.”

If there are remaining seller concessions may they be used to prepay items such as additional months of HOA or an additional year of home warranty? Probably not, since neither of these items is a loan cost or a condition to fund the loan.

Additional Seller Concessions are Negotiable

Just as all repairs are negotiable since the seller warranties were removed from the new Contract, the buyer may negotiate additional items that seller concessions may pay. A buyer may want to add language in the Additional Terms and Conditions section of the Contract to read something like this, “Seller concessions to be applied to the following items…”

Initial Appraisal Fee and Seller Concessions

Section 2m lines 111-113 read:

Initial appraisal fee shall be paid by __Buyer __Seller __Other at the time payment is required by lender and is non-refundable. If Seller is paying the initial appraisal fee, the fee __will __will not be applied against Seller’s Concessions at COE, if applicable.

Recently, a seller agreed to pay the initial appraisal fee of $500 to the lender at the beginning of the transaction. The $500 was to be applied against a seller concession of $4,000.

When the Closing Disclosure was sent to the seller it showed the seller’s concession at COE to be $4,000 instead of reducing it to $3,500, since the seller had already paid $500 for the appraisal.

Apparently, the lenders software was not able to show the seller paying the initial appraisal fee outside of escrow. The Closing Disclosure incorrectly showed that the buyer had paid it outside of escrow. Since the problem was found before closing it was resolved.

Conclusion

Most buyers think that when a seller agreed to give them a concession they will be able to use all of it. They do not understand all the nuances of its application. A buyer may consider adding language to the Contract, and they should discuss with their lender any limitations the lender may have with a seller concession.

Fletcher R. Wilcox is the author of The Wilcox Report and Vice President of Business Development for Grand Canyon Title. His market analysis has been referenced in the Wall Street Journal, Bloomberg News, HousingWire.com and National Mortgage News. He served on one of Arizona Association of Realtor’s 2017 Residential Resale Contract subcommittees. He may be reached at FWilcox@GCTA.com or by phone at 602-648-1230.

Follow Fletcher