April 18, 2019 edition of The Wilcox Report

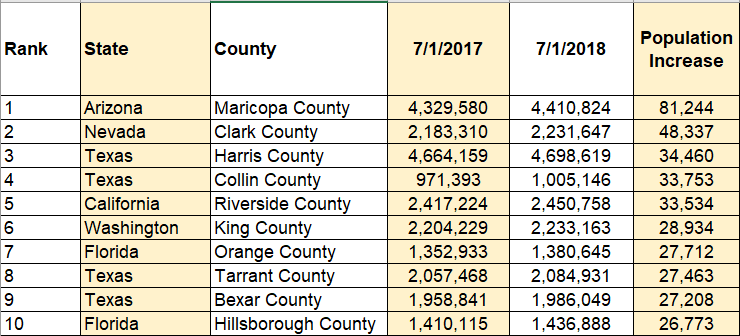

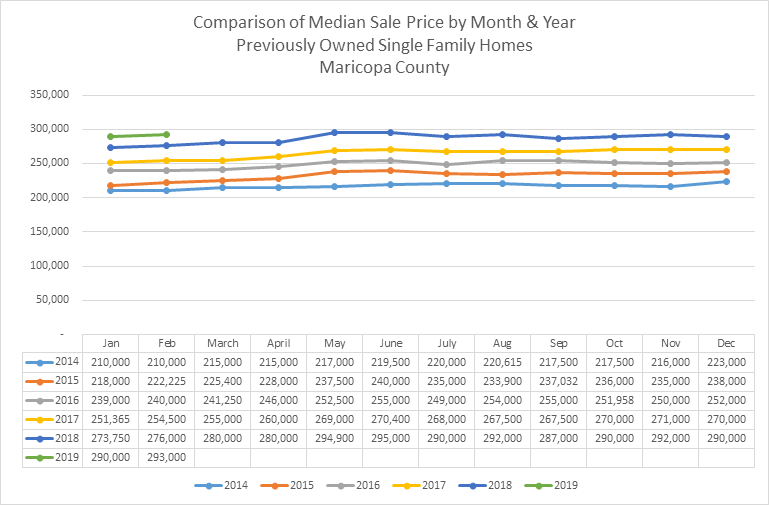

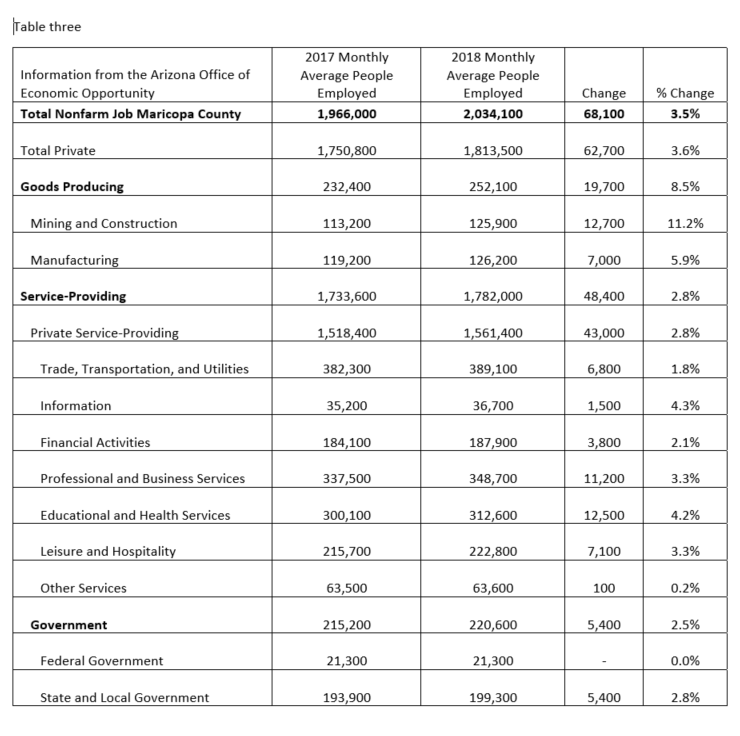

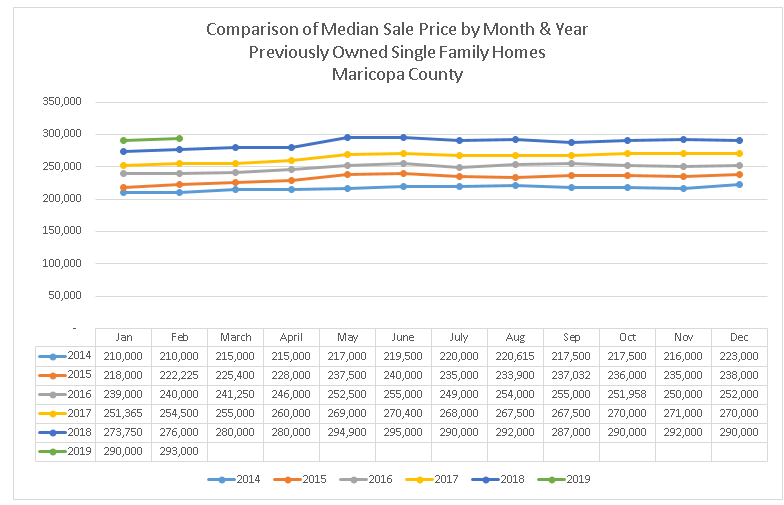

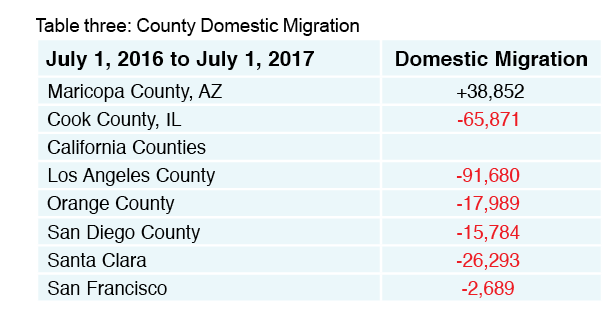

Today the U.S. Census Bureau delivered their report on population growth in the United States. Out of the 3,142 counties in the United States Maricopa County had the largest increase in population. As predicted this is the third year in row that Maricopa County has led all counties with the greatest increase in population. Year-over-year the U.S. Census Bureau showed the population of Maricopa County increasing by 81,244 or 222 people per day. This increase of 222 per day outshined last year’s report by 20 or ten percent more people per day when the population grew by 202 per day.

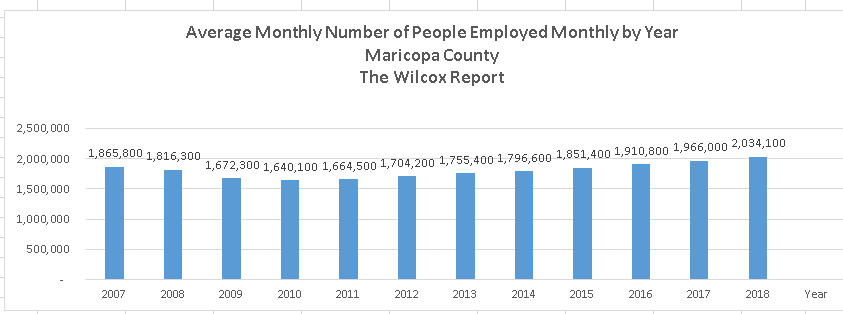

Today’s release by the U.S. Census Bureau substantiates that Maricopa County (Greater Phoenix) is a top destination for employers locating and relocating their operations in Maricopa County to take advantage of our population growth.

Even though Maricopa County (Greater Phoenix) is one of the most competitive markets in the country to be a real estate agent it also shows that there is tremendous opportunity for agents because of the growth in population and jobs.

For more information on how as a real estate you can be influential with sellers and buyers and take advantage of job and population growth, contact me to attend one of my classes on 2019 INFLUENCER MARKETING!

Fletcher R. Wilcox is V.P. of Business Development and a Real Estate Analyst at Grand Canyon Title. Grand Canyon Title is a subsidairy of Fidelity National Financial (FNF). FNF is ranked 302 on the FORTUNE 500® list of America’s largest companies.

Fletcher speaks throughout Greater Phoenix and teaches Influencer Marketing to real estate agents. Fletcher is the founder of The Wilcox Report. His market analysis on residential real estate in Greater Phoenix has been mentioned in publications such as the Wall Street Journal, MarketWatch, Bloomberg News, HousingWire.com, National Mortgage News, the Arizona Republic and the Phoenix Business Journal. He has been a guest speaker on both local and national TV and radio. He served on one of the three Arizona Association of REALTORS® subcommittees which made recommendations for changes to the 2017 AAR Residential Resale Real Estate Purchase Contract. Fletcher may be reached at fwilcox@gcta.com and 602.648.1230

Follow Fletcher