Results for July 2020

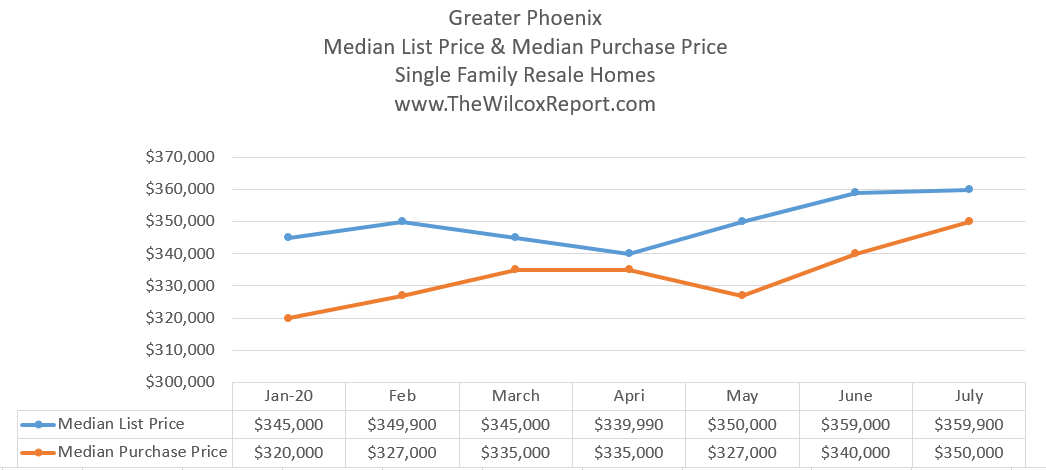

July reached a new high for what buyers were willing to pay for a single family resale home in Greater Phoenix. The July median purchase price was $350,000. This breaks the previous record, set in the previous month. In June it was $340,000, ten thousand or three percent less than in July. The July 2020 median purchase price was $40,000 higher than in July 2019 when it was $310,000.

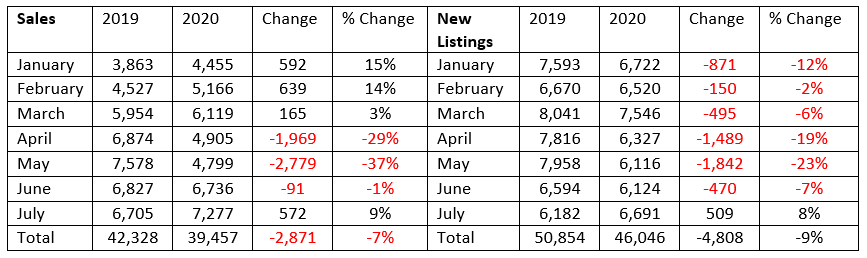

July sales of single family resale homes were higher this month than any other month thus far into 2020. There were 7,277 sales. This is the first time this year that there were over 7,000 in a month.

The median list price in July for a single family resale home also reached a new high. It ended at $359,900 slightly higher than in June when it was $359,000. The median list price had fallen in April of this year to $339,900 after some sellers lowered their sale prices during the coronavirus public restrictions. Since April it is back up $20,000. The July 2020 median list price was $44,900 higher than in July 2019 when it was $315,000.

New monthly listings saw a surge July. More sellers put their homes for sale on the market in July than in any of the previous three months. July new monthly listings of single family resale homes were 6,691. This is eight percent or 509 more new listings in July than in June. Historically the number of new monthly listings is always lower in July than in June. But, of course in today’s marketplace what is historic patterns may not be relevant.

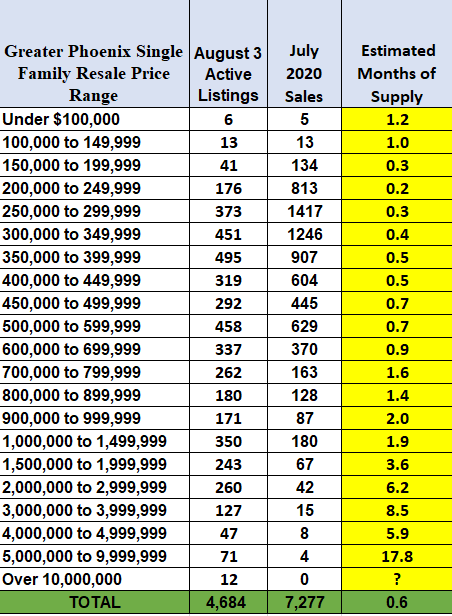

Estimated Months of Supply is low for all prices ranges under $1,500,000. It is extremely low for home under $700,000 with less than a one month supply.

How single family resale homes were purchased had one significant change in July 2020 compared to July 2019. Cash purchases in July 2020 were eleven percent compared to seventeen percent in July 2019. Conventional and jumbo loan purchases were about breakeven. With sixty-two percent in July 2020 compared to sixty-one percent in July 2019. FHA purchases in July 2020 were fifteen percent compared to thirteen percent in July 2019. Finally VA purchases were seven percent in July 2020 and eight percent in July 2019.

Comparing mortgage payments over time. Table – compares a principle and interest payment for four time periods: July 2020, July 2019, July 2018 and July 2006. These are the assumptions for the comparison: the median purchase price in that month and year with a ten percent down payment. The mortgage rate is what the thirty-year fixed mortgage was the month before the closing according to Freddie Mac. The comparison shows a principle and interest payment of $1,495 in July 2020 compared to $1,423 in July 2019. So the July 2020 payment is seventy-two more dollars than in July 2019. Of course with a ten percent down payment a borrower in 2020 would need four thousand more dollars in down payment funds than July 2019. The interest rate in July 2020 was 3.16% compared to 3.80% in July 2019. While the price to own has gone up seventy-two dollars more in a principal and interest payment under this scenario, remember the purchase price went up $40,000 in one year. When comparing a principal and interest payment in July 2020 to July 2006, which was the year prices peaked before the great real estate recession, we find a noteworthy comparison. The principle and interest payment in July 2006 is $1,734. This is $236 more dollars than in July 2020. Even though the median purchase price in July 2020 is $70,000 higher than in July 2006. Why then is the principle and interest payment so much lower in July 2020 than July 2006? The difference is that the thirty-year fixed mortgage rate was 6.68% in July 2006 compared to 3.16% in July 2020.

Conclusion

The increase of more sellers putting their homes on the market in July is a good thing. It will add to sales. Overall it will do very little to change the estimated months of supply, since supply is already so low and demand is so strong. I don’t ever recall seeing the inventory of single family resale homes this low. Low mortgage rates are keeping many buyers in the home buying market even with whooping increases in purchase prices. At the same time low rates make more buyers, more buyers put pressure on prices.

The Greater Phoenix residential market of single family resale homes is a bright spot in our economy. This specific market is one of the best performing in the country – if not the best. At this time, expect this market to continue its current path for the rest of the year.

The Greater Phoenix residential market in this report is defined as Maricopa County. The information for this report was compiled from the Arizona Regional Multiple Listing Services, Inc.

Fletcher R. Wilcox is V.P. of Business Development and a Real Estate Analyst Grand Canyon Title. Grand Canyon Title is a subsidiary of Fidelity National Financial (FNF). FNF is ranked 375 on the list of Fortune 500 Companies. Fletcher may be reached at fwilcox@gcta.com or 602.648.1230.

Fletcher is on the Board of Directors at the Scottsdale Association of REALTORS® (SAAR). In 2020 he started an Influencer Marketing series for real estate agents at SAAR. He is V.P. of Networking for the Arizona Mortgage Lenders Association. He is a member of the Arizona State Escrow Association and the Arizona Association of REALTORS.

Fletcher is the founder of The Wilcox Report. His market analysis on residential real estate in Greater Phoenix has been mentioned in publications such as the Wall Street Journal, MarketWatch, Bloomberg News, HousingWire.com, National Mortgage News, the Arizona Republic, the Phoenix Business Journal and AZ Big Media. He has been a guest speaker on both local and national TV and radio. He served on one of the three Arizona Association of REALTORS® subcommittees which made recommendations for changes to the 2017 AAR Residential Resale Real Estate Purchase Contract. He teaches residential contract law to both real estate agents and escrow officers.

Follow Fletcher