It appears residential sales of single family homes in Greater Phoenix (Maricopa County) are on their way to a V-shaped recovery and that the median purchase price may reach an all-time high this June.

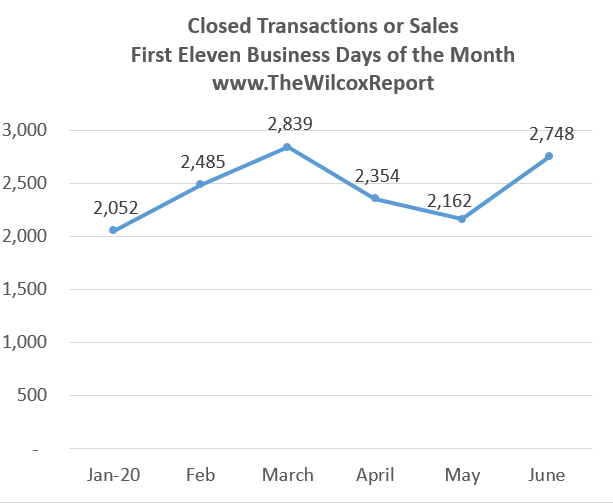

June to Rival March for 2020 Month with Most Residential Sales – Sales Hit Bottom in May

March of 2020 is the month this year with the highest number of sales of single family resales in Greater Phoenix. There were 6,122 sales in March. Sales this June may end up higher than March sales.

June of 2020 has twenty-two business days to close a transaction or sale. Business days are defined as the number of days in a month in which both the escrow company that is closing a sale, and the county recorder in which a property is located are open on the same day. For a transaction to close the escrow company sends the necessary documents to the county recorder to be recorded. Once the county recorder records the documents the transaction is closed and the sale is complete.

For the first eleven business days or first half of June, June sales are running a close second compared to March. There were 2,748 sales in the first eleven business days this June compared to 2,839 sales in the first eleven business days in March. With all the pent up demand June may overtake March in total sales.

NOTE: The focus of this report is the sale of single family resales in Greater Phoenix (Maricopa County). The information in this report is compiled from the Arizona Regional Multiple Listing Services, Inc. (ARMLS). ARMLS data shows that approximately eighty percent of all their sales every month in Greater Phoenix are single family resales.

Sales of single family resales in Greater Phoenix most likely hit the bottom in May. May had 4,787 sales which were the lowest number of sales since January. When comparing sales in the first eleven business days of May to June, there are 586 or twenty-seven percent more sales in June. June sales appear to be forming a V-shaped recovery. June sales most likely will be in the range of 6,100 to 6,300 sales. Even if June 2020 sales are over 6,000, they will fall short of the 6,827 sales in June of 2019. But, hey, we are in recovery.

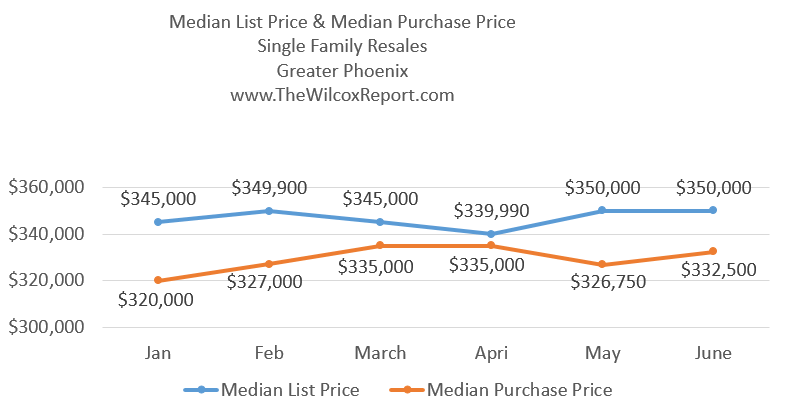

Median Purchase Price Going Up in June after Dropping in May

The median purchase price of a single family resale dropped in May. In May it was $326,750. This was a drop of $8,250 or two percent from April when it was $335,000. It is back up in June. For the first half of June it is $332,500. It most likely will be higher by the end of June. PREDICTION: When the final June results are in – the median purchase price of a single family resale may break the previous record of $335,000 set in March and April of this year.

The median list price of a single family resale dropped in April to $339,990, the lowest of the year. In May it went back up to $350,000 and is at $350,000 for the first-half of June.

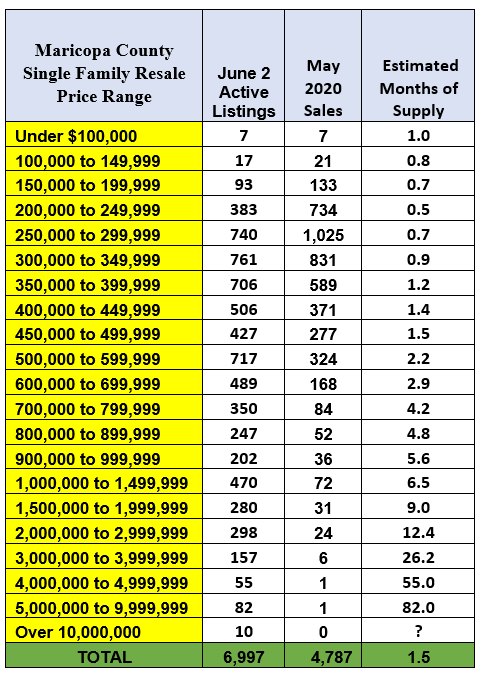

Inventory of Single Family Resales

With both sales and listing inventory down year-over-year the estimated months of supply has changed very little. With the recent increase in sales, active listings are down. On June 1st, there were 7,114 active listings. On June 15th 6,411 active listings. There is less than a one month of supply of listings under $350,000. For listings from $350,000 to $500,000 there is less than a two month supply. See the table below for active listings and the estimated months of supply by price range.

Look-Out for July! It May Be a Better Month than June

Look for the V-shape to firm up in July. On June 1st there were 4,904 single family resales under contract. On June 15th there were 5,556 under contract. The majority of these will close in July. Another reason why the median purchase price may hit $335,000 or more in June and surely in July is because median purchase price lags median list price. Currently the median list price is $10,010 higher than in April.

Boon for Builder Stocks, Housing Market Shows Early Signs of a V-Shaped Recovery BARRONS By Lisa Beilfuss June 17, 2020 10:35 am ET

Median Purchase Price Single Family Resales

Active Listings and Estimated Months of Supply

Fletcher R. Wilcox is V.P. of Business Development and a Real Estate Analyst Grand Canyon Title. Grand Canyon Title is a subsidiary of Fidelity National Financial (FNF). FNF is ranked 375 on the list of Fortune 500 Companies. Fletcher may be reached at fwilcox@gcta.com or 602.648.1230.

Fletcher is on the Board of Directors at the Scottsdale Association of REALTORS® (SAAR). In 2020 he started an Influencer Marketing series for real estate agents at SAAR. He is V.P. of Networking for the Arizona Mortgage Lenders Association. He is a member of the Arizona State Escrow Association and the Arizona Association of REALTORS.

Fletcher is the founder of The Wilcox Report. His market analysis on residential real estate in Greater Phoenix has been mentioned in publications such as the Wall Street Journal, MarketWatch, Bloomberg News, HousingWire.com, National Mortgage News, the Arizona Republic, the Phoenix Business Journal and AZ Big Media. He has been a guest speaker on both local and national TV and radio. He served on one of the three Arizona Association of REALTORS® subcommittees which made recommendations for changes to the 2017 AAR Residential Resale Real Estate Purchase Contract. He teaches residential contract law to both real estate agents and escrow officers.

Follow Fletcher