The upper end of the market has had more sales so far this year than last year.

According to data from the Arizona Regional Multiple Listing Services, Inc. (ARMLS) there were twenty-one more sales over $1,000,000 of previously owned single family homes in the first quarter of 2016 than the first quarter of 2015. The geographic area is Maricopa County.

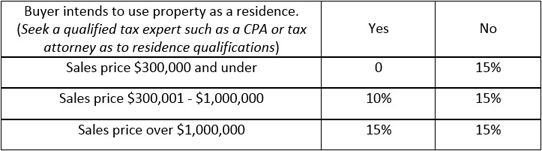

The table below segments the sales by price range.

Join me this Wednesday, April 20 from 11:00 a.m. to 1:00 p.m. for a tour of six homes in the Biltmore Estates. The beautiful Biltmore Estates is located on Lincoln west of 32nd street in Phoenix. See the great views! NOTE: THIS IS A REAL ESTATE AGENT ONLY TOUR.

Hope to see you!

Fletcher R. Wilcox

V.P. Business Development

Real Estate Analyst

Grand Canyon Title Agency

A Division of FNTA

602.648.1230

Author of www.TheWilcoxReport.com

A report on real estate, lending and job growth trends in Greater Phoenix.

Follow Fletcher