Phoenix housing market is coming back, report says

By Philip Haldiman, Editor-in-Chief | The Dealmaker

The Phoenix housing market has moved into recovery mode, according to a new report on single-family home sales, mortgage lending and job growth trends.

Arizona real estate analyst Fletcher Wilcox, author of the report, told The Dealmaker that while there is still pain in the local housing market, it’s now bouncing back because distressed properties have declined greatly, preventing home values from sky-rocking downward.

Another important factor is job growth in metropolitan Phoenix, he said.

“While job growth is lower than it has been historically — around two percent compared to four percent — greater Phoenix has gained back about 70 percent of jobs that were lost,” Wilcox said. “For the housing market to grow there has to be jobs.”

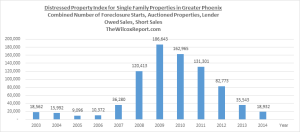

In greater Phoenix in 2009, 186,643 single-family properties either went into foreclosure, were auctioned, were sold as lender-owned properties or were short sales, Wilcox said.

Last year that number was 18,932, a 90 percent decrease.

The 2014 Distressed Property Index, which includes foreclosures, auctions, lender-owned properties and short sales, is now the lowest since 2006, Wilcox said.

“(Home values) have appreciated from the low point in August 2011,” he said. “Back then the median sale price for a single family property was $120,000. In December 2014, the median sale price was $222,000.”

Highlights from 2014, Maricopa County

- Foreclosure returned to 2005 levels.

- Auctioned properties returned to 2003 levels.

- Lowest lender-owned sales since 2007.

- Lowest number of short sales since 2008.

(Source: ARMLS, compiled by Wilcox Report) Posted by Philip Haldiman / January 27, 2015

Will 2015 be a buyers or sellers real estate market? Stay tuned for the next report on the decrease in new listing inventory and the increase in mortgage purchases.

Fletcher Wilcox

Follow Fletcher